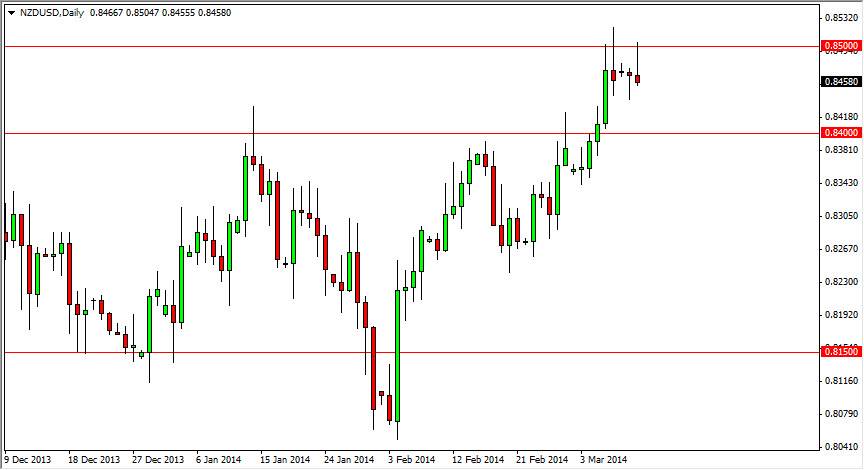

The NZD/USD pair had a positive session initially during the day on Tuesday, but as you can see failed at the 0.85 level again. However, there is also a hammer from the Monday session, which tells me that the market is probably trying to catch its breath here before making a serious attempt to break out to the upside. A lot of new traders get sucked into the idea that busting through resistance right away means that it’s a strong move, while that somewhat true, real strength is one of markets it’s just below area and gradually chipped away at the resistance. That’s because that means there is serious and significant thought going into the trade, it’s not a knee-jerk reaction

I think that’s what’s going on in this market at the moment. With that, I’m still looking at buying opportunities when we pullback in show signs of support. I also believe that the 0.84 level should offer a significant amount of support as well, so pullback to that area that show signs of supportive action would be enough for me to start buying.

That being said, a breakout would be nice too.

All things being equal, I would prefer to see a pullback is a gives us an opportunity to pick up value, but at the end of the day if we break above the shooting star from Friday, that’s good enough as well. After all, it would show a breakdown of that resistance from Friday, as well as the large, round, psychologically significant number at 0.85. When things like that happen, a lot of traders out there will sit up and take notice. Herd mentality takes over, and everybody start buying or at least covering their short positions.

On a move above that area, we are looking at a move to the 0.90 level in my opinion. As far selling is concerned, I’m sure there will be a scenario they could give be doing it, but I simply do not see it at the moment.