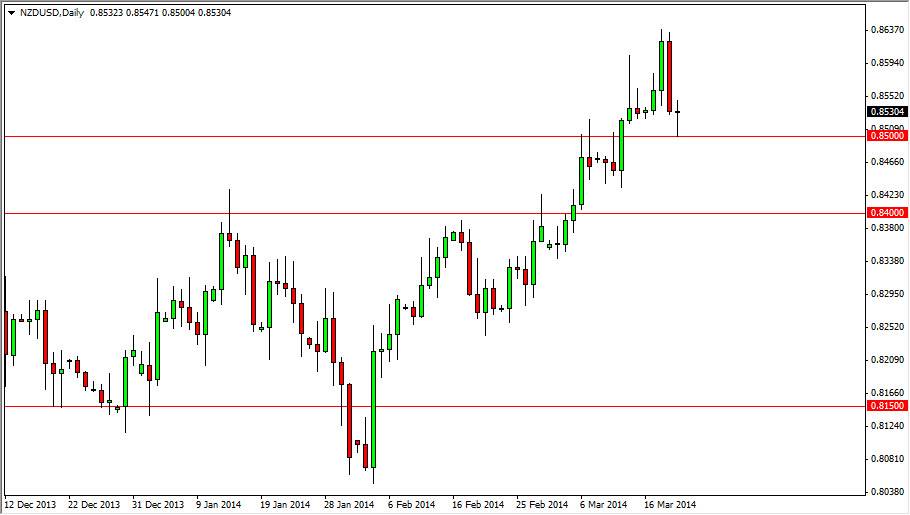

The NZD/USD pair fell during the session on Thursday, but found enough support at the 0.85 level to turn things back around and form a nice-looking hammer. The hammer of course is a very positive sign, and we have been in a very nice uptrend recently. Because of this, I feel that a break of the top of this hammer is in fact a decent buy sign, and that the market will at least tried to get to the recent highs at roughly 0.8650 or so. Because of this, I feel that this market is probably one that will more than likely produce nice profits in the short-term, but it is not until we get above the recent high that I feel we start to reach towards the real target of this market which I have as the 0.90 level.

Looking at this market, the move above the 0.85 level was in fact a nice breakout, and now that we have formed this hammer, I feel that we have retested that area for support. It appears to have held, and therefore I feel that the New Zealand dollar will continue to strengthen. It’s kind of odd though, because the New Zealand dollar tends to be very sensitive to the commodity markets. Right now, the commodity markets are little bit of a mixed bag, and quite frankly there are more than enough reasons to be nervous about financial markets at the moment, especially considering that Russia is involved in something that could flare into something much more important.

New Zealand dollar seems to be stronger, and that’s all that matters.

At the end of the day though, all that matters is that the New Zealand dollar is strengthening. Because of this, all you can do is buy it, and it really doesn’t matter why. One of the biggest mistakes that people make when trading Forex a story far too much about the “why” something happens, as opposed to the “what.” At the end of the day, this market looks like it’s going higher, and that’s really all I need to now.