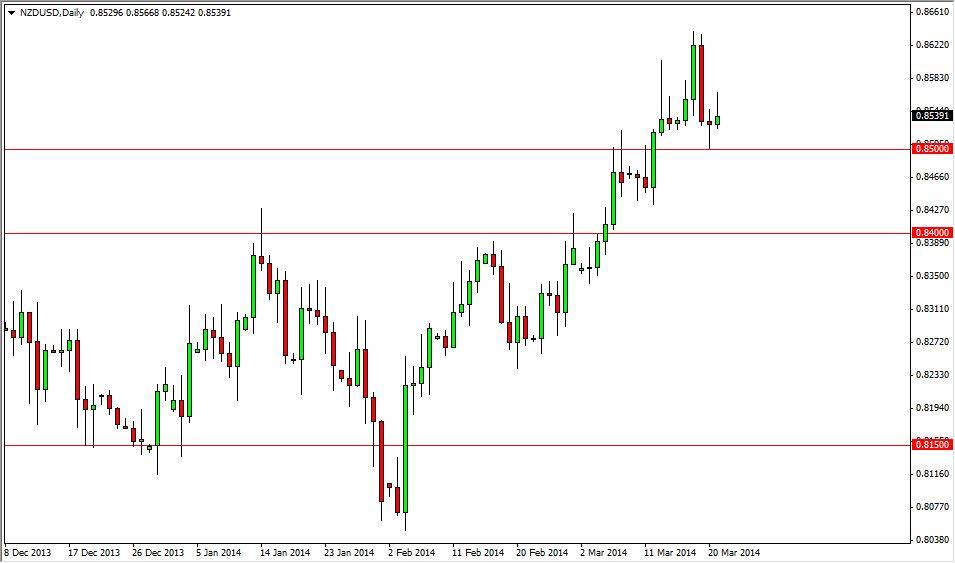

The NZD/USD pair rose during the session on Friday, breaking the top of the Thursday hammer. While this is normally a very bullish sign, the market turned right back around and formed a shooting star, which of course is a very negative sign. I do not look at this is a selling opportunity though, I think this is just simple confusion. This market looks like it is confused at the moment, but I also believe that there is a significant amount of support all the way down to the 0.84 level. With that being the case, I would still have an upward bias in this market, but recognize that a pullback could very well happen.

It is not until we get below the 0.84 level that I feel comfortable selling this market for any significant amount of time. Quite frankly, there’s a significant amount of support below there as well, which of course is going to make anything difficult from the downside, even if it ends up being the correct trade.

Watch the commodity markets

One thing you will have to do while trading this pair is obviously watch the commodity markets. The commodity markets generally drive the New Zealand dollar, albeit in a somewhat sideways manner. This market tends to follow risk appetite in general, not necessarily a particular market or two. Because of this, pay attention to the overall attitude of commodity markets out there, and to a lesser extent stock markets in order to get a feel for what’s going on.

Pullbacks should continue to be buying opportunities, and less of course we break the aforementioned 0.84 handle. That level should be the “floor” of this market if we choose to stay bullish. If not, things could get interesting as they typically do in this pair, as it is well known to be one that go sideways for a very long period of time, and then suddenly will get parabolic or fall off of a cliff. That being the case, you always have to have your eyes open when trading the New Zealand dollar, but right now I’m still looking at it as a bullish pair.