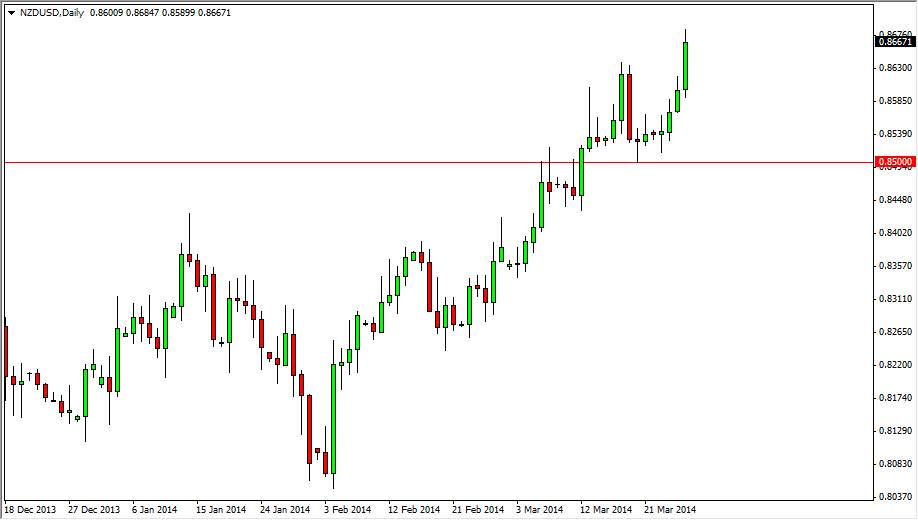

The NZD/USD pair rose during the session on Thursday, breaking above the 0.8650 level. That being the case, I believe that this market continues to go much higher, ultimately claiming the 0.90 handle, a long-term target that I have been watching ever since we broke above the 0.85 handle. In fact, I believe the fact that the market broke out during the session on Thursday signals that we will probably get their sooner than later, which of course is going to be very positive for risk appetite as the New Zealand dollar tends to mimic that very action.

Global markets will have to be watched, but the New Zealand dollar tends to do well when there is a general “risk on” type of attitude around the world. Watch the stock markets, and especially the futures markets, as they can give you an idea of where this market ultimately wants to go. I believe that the 0.85 level should offer quite a bit of support, as the area was such a significant resistance area.

Pullbacks should offer buying opportunities going forward.

I believe that the market should offer plenty of buying opportunities on the pullbacks, as there will be people who want to enter this marketplace based upon the fact that we broke out, and a lot of people will have missed that move. I believe that the pair will more than likely struggle from time to time, which of course is only natural when you have a global marketplace that is skittish at best. Nonetheless, there should be plenty of buying opportunities going forward, and this market will without a doubt be one of the favored ones in order to express risk appetite increasing.

I see no way to sell this pair until we get well below the 0.85 level, as it should be massively supportive. The area should bring in buyers every time we get close to it, and with that I would be a buyer on any type of supportive candle down at that level as well. I believe that it is essentially a “floor” in this market now.