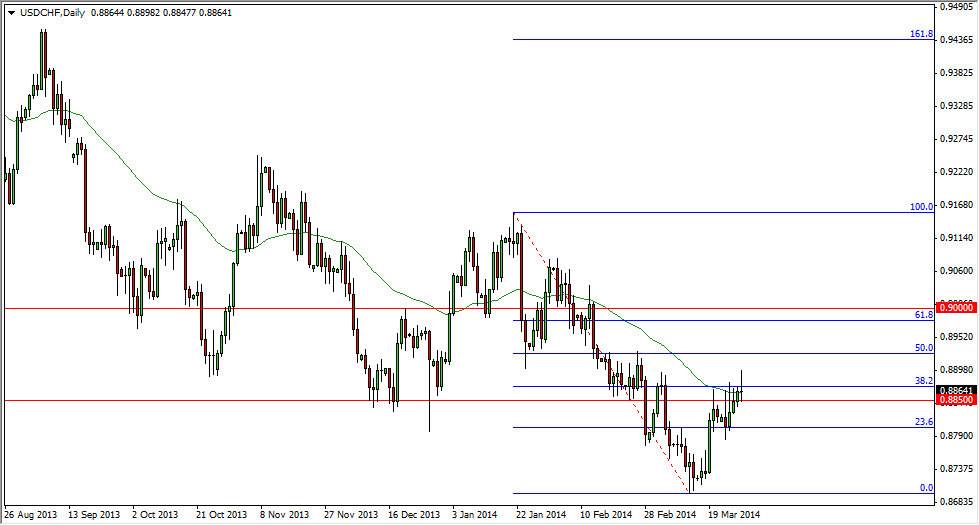

The USD/CHF pair tried to rally during the session on Friday as you can see, but failed and formed a wicked looking shooting star. There have been several shooting stars lately, which I essentially believe are centered on the 0.8850 level. It is because of this that I feel shorting this market on a break of the low of the shooting star from the Friday session would be reasonable, although there could be a little bit of residual support below. We are most certainly in a negative trend, and as a result this would simply be a continuation of what we’ve seen. This is essentially a pullback to the previous support that had kept the market afloat, and it appears that we are trying to fail in this general vicinity. By far, following the overall trend is going to be the easiest trade on any given chart, and that’s exactly what this would be.

Technicals lining up for a nice short trade.

Looking at the shape of this candle that would be the first thing that caught my attention. On top of that though, there is the 50 day exponential moving average that is slicing right through this candle. That of course is a major moving average, so it’s hard for me not to think that there are larger traders out there paying attention to this.

Adding more credence to this trade is the fact that we have stalled here at the 38.2% Fibonacci retracement level. That of course is a major one, and the fact that there is a cluster just above us also tells me that this market is more than likely going to fall from here. All I need this point time is some type of confirmation, which of course would be a daily close below the 0.8850 level, and then at that point in time I be more than willing to buy the Swiss franc. For what it’s worth, the Swiss franc seems to be doing better against most currencies right now, so I believe that this trade makes sense overall.