USD/JPY Signal Update

Yesterday’s signal expired without being triggered as the price never reached 100.88.

Today’s USD/JPY Signal

Risk 0.50%.

Entry must be made before 8am London time tomorrow.

Long Trade

Enter long following a next bar break of any bullish pin or engulfing hourly candle forming after the first touch of 100.88. From two hours following the close of the first hourly candle that closes below 100.88, this trade is invalidated.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price is 20 pips in profit. Remove 75% of the position as profit at 101.25, and leave the remaining 25% to run.

Short Trade

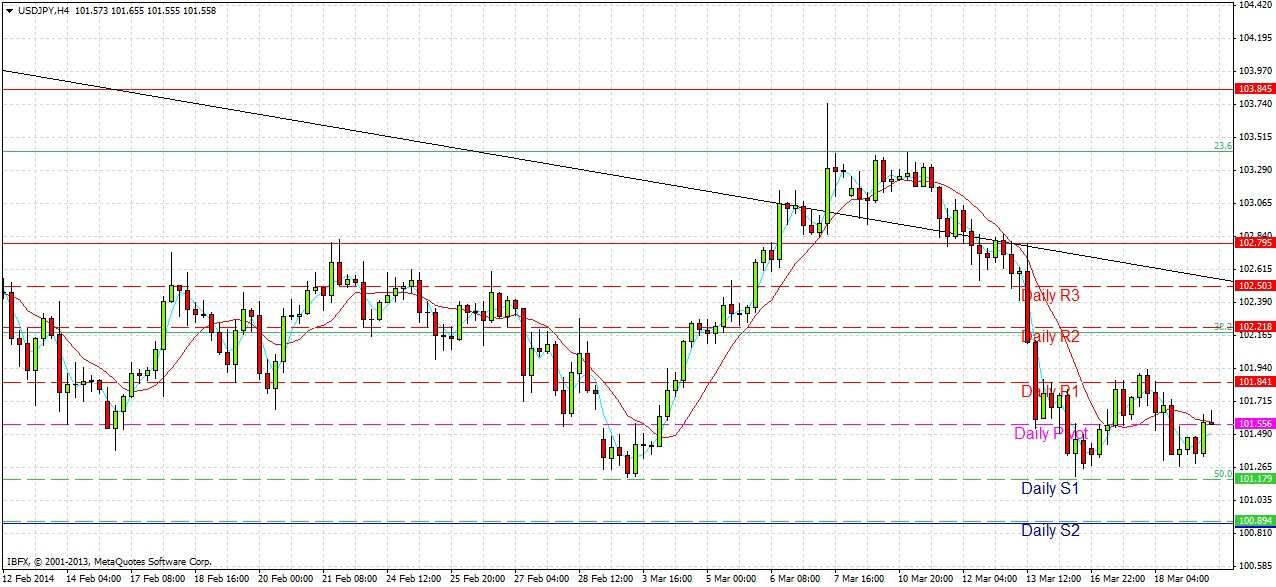

Enter short following a next bar break of any bearish pin or engulfing hourly candle forming after the first touch of 102.79. From two hours following the close of the first hourly candle that closes above 102.79, this trade is invalidated.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 20 pips in profit. Remove 75% of the position as profit at 102.10, and leave the remaining 25% to run

USD/JPY Analysis

Yesterday we were unable to break below the double bottom at the 50% Fibonacci level of 101.20, so the price has moved up somewhat but not very strongly. A candlestick analysis shows that we are stuck in a ranging/consolidation type of pattern, with no obvious clues as to what is likely to happen next.

Looking at the smaller picture, it seems that the key levels to watch are the support at 101.20 and the descending trend line acting as resistance which is now at about 102.50 which is also a key psychological level. Breakouts from these levels may well not be decisive though, as the levels just beyond both of them at 102.79 and 100.88 are likely to be stronger. Breaches of these levels will be very significant and this just might happen after the FOMC statement tonight or when the Governor of the Bank of Japan speaks tomorrow morning.

Today at 6pm London time, the FOMC statement and projections will be released, which may be a major market event. Tomorrow morning at 5:15am the Governor of the Bank of Japan will speak. It can be expected that this pair will be fairly quiet before about 5pm, with spikes in activity at that time and again around the time that the Governor speaks.