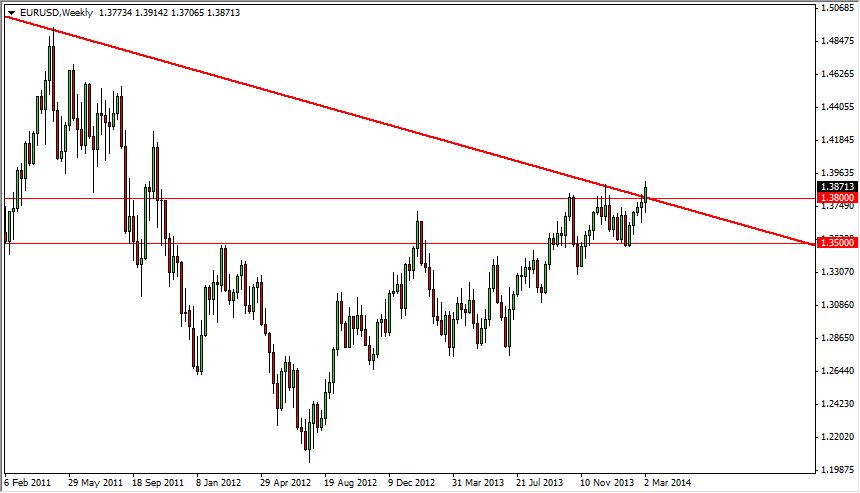

EUR/USD

The EUR/USD pair rose during the previous week, busting through the 1.38 resistance area finally. The area has been massively resistive, but in the end this pair didn’t fall as far this time, and in turn showed that perhaps it was picking up strength. With the ECB suggesting it wasn’t going to expand monetary policy, the fears of lower interest rates in the EU has dissipated a bit.

However, I am more interested in the idea that we have broken above the downtrend line from the financial crisis. This has been a channel that has been strong to say the least, and now that we have closed on the weekly chart above it – this pair could really pick up strength at this point.

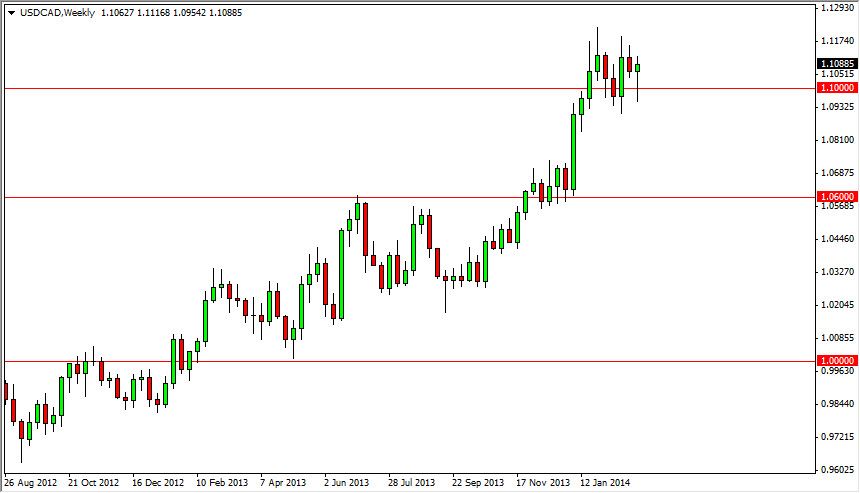

USD/CAD

The USD/CAD pair initially fell for the week, but found a lot of support below the 1.10 level, and bounced enough to form a hammer. Because of this, I think this pair will ultimately breakout to the upside, but the 1.12 level needs to be overcome for any real long-term move to happen. Above the 1.12 level, this pair goes to the 1.15 area. Pullbacks at this point will more than likely offer buying opportunities.

USD/JPY

The USD/JPY pair was strong during the week, as we closed above the 103 level. The market has been in an uptrend for some time now, and I think we are going to test the 105 level soon. In fact, I think we go above there and aim for the 110 level. With the better than expected non-farm payroll numbers, we could see a move in this pair to the upside in short order. The trend line should continue to offer support, and I think we have started to move to the upside for the next leg higher.

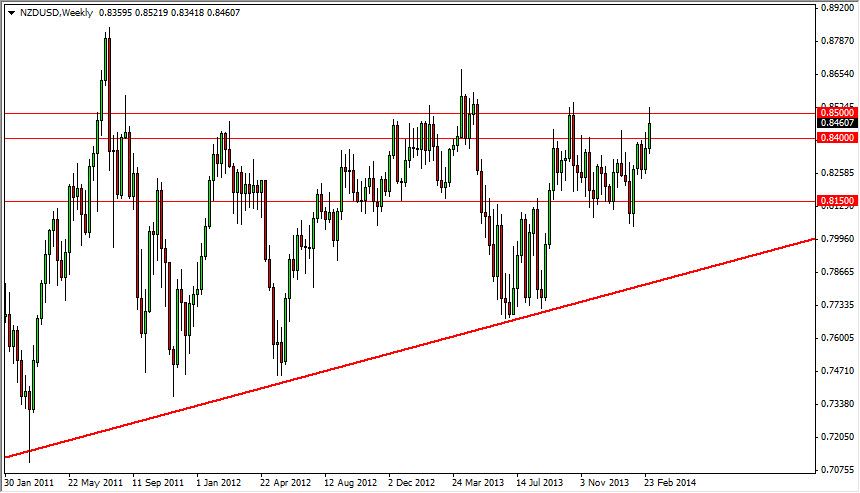

NZD/USD

The NZD/USD pair rose during the week as well, but failed at the 0.85 level. This area will have to be broken to the upside in order to continue going higher, and as a result I am on the sidelines. However, this latest weekly candle suggests to me that we are in fact going to breakout given enough time.