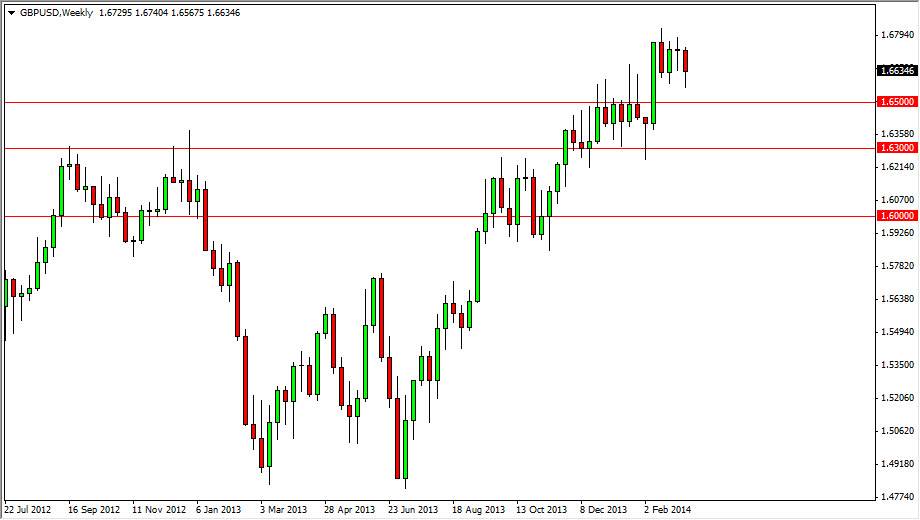

GBP/USD

The GBP/USD pair fell during the course of the week, but as you can see got a little bit of a bounce towards the end of the week. Because of this, I feel that this market is going to continue to go higher eventually, but in the meantime it looks like the market is ready to go sideways. It’s not a big surprise, as is market consolidates quite a bit. Ultimately though, we have broken out to the upside for a reason, and I still believe that this market goes to the 1.70 level given enough time.

EUR/USD

The EUR/USD pair went back and forth over the course of the week, testing the 1.39 handle. We closed right there at the end of the week though, and because of this I believe that we are testing what is a longer-term downtrend line, and as a result if we get above the highs of the week, I would be wildly bullish of the Euro. With this, the market could go as high as 1.50 level, and I think this would be a nice longer-term move. However, if we managed to break below the 1.37 level, I would be wildly bearish. In the meantime though, I would suspect that the upside is probably going to win out.

USD/CAD

The USD/CAD pair went back and forth during the course of the week, ending up printing a neutral candle. It looks as we are grinding away in a sideways consolidation still, which makes sense considering how parabolic the move was from the 1.06 level. I think that this market continues to go higher though, but we need to get a break above the 1.12 level in order to get a move to the 1.15 level.

AUD/USD

The AUD/USD pair fell initially during the week, but as you can see bounced from below the 0.90 handle in order to form a hammer. With that, I believe that the buyers are starting to finally flex their muscles down here. On a break above the highs of the hammer, I think that we would head to the 0.9250 handle, and then possibly the 0.95 level. In the meantime though, I am simply observing this pair as this would be a trend change, something that the very rarely done smoothly as the markets will quite often be a bit on the confused side initially.