USD/CAD

The USD/CAD pair fell slightly during the week, but remains in the consolidation area that we had seen just above the 1.10 level for some time now. On this chart, you can see that I have drawn lines suggesting that we could be forming a little bit of a bullish flag. If that bullish flag does in fact breakout, we could be looking at a move to roughly 1.15, which is where I’ve had a target for some time now. That being said, I am waiting for the breakout and then I will start buying this pair. I have no interest in selling at the moment, and would look at any pullback at this point in time as an opportunity to buy this market closer to the 1.07 level.

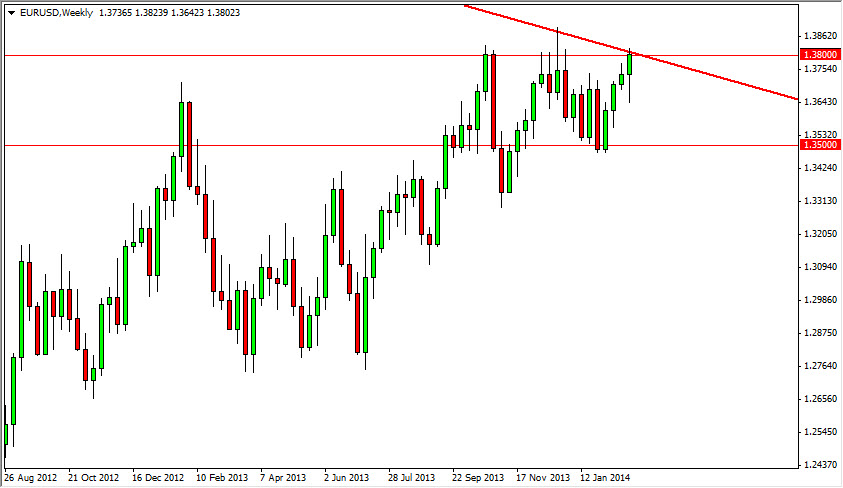

EUR/USD

The EUR USD pair initially fell during the week, but it’s a very interesting: it bounced hard and formed a hammer. The hammer sits just below a downtrend line that is actually from the monthly chart. It is the top of the downtrend channel that has been around since the beginning of the financial crisis. I now believe that a move above the 1.39 level would be massively bullish for this pair, and that could signal a major break out. Alternately, a break of the bottom of this hammer could also signal that the market is ready to continue grinding lower over the longer term, and that in itself would be a nice long-term opportunity as well. Stay tuned, this will be one of the more interesting pair soon.

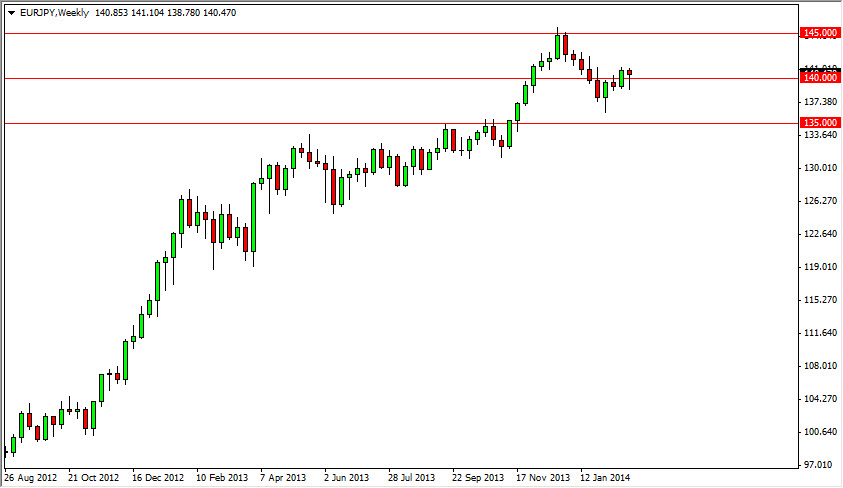

EUR/JPY

The EUR/JPY pair is probably the best setup at the moment as far as I can tell. Bit of a perfect looking hammer at the 140 level, which of course is a natural place to find resistance based upon the large, round, psychologically significant number. Because of this, I am very bullish of this pair and believe that a break of the highs from the previous week is reason to start buying and aiming for 145 at first, and then ultimately much higher. Selling is not a possibility at this point in time as far as I can tell, and any pullback should more than likely invite a lot of buying below.

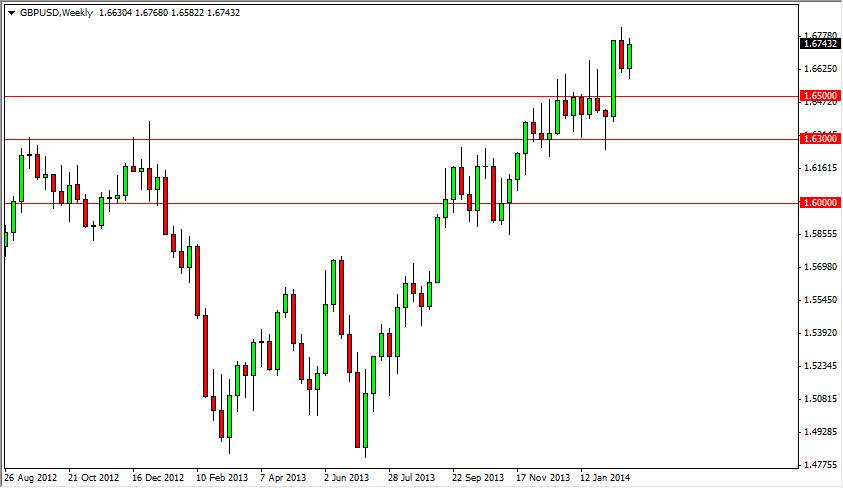

GBP/USD

The GBP/USD pair rose during the week, retracing most the losses from the previous one. I believe that this market is ready to continue going higher based upon that, and the fact that we have a massive bullish candle two weeks ago. At this point in time, I believe that given enough time, the GBP/USD pair is heading to the 1.70 level.