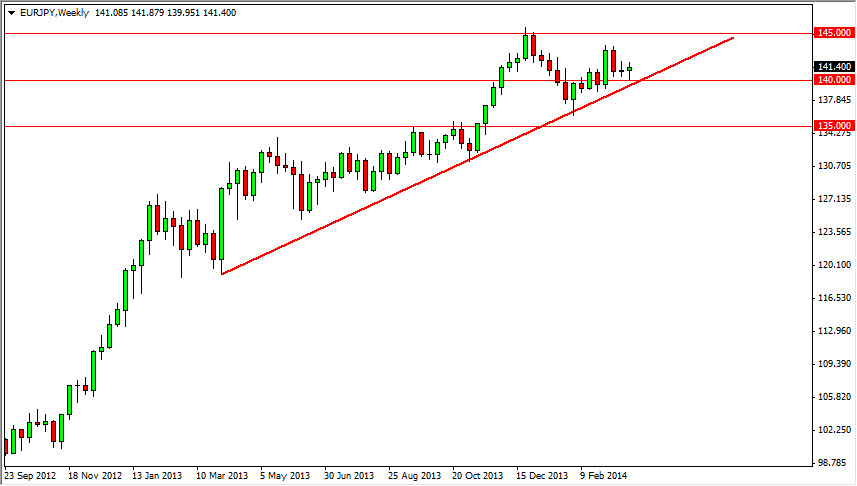

EUR/JPY

The EUR/JPY pair fell during a large portion of the week, but as you can see found support near the 140 level. On top of that, we are getting close to an uptrend line that should continue to offer support in this market. This tells me that the pair could make a move in the next week or two, and ultimately challenge the 145 level. That has been an area that the market found trouble at previously, but the fact that we would back up and trying to add more bullish pressure before breaking out really isn’t that big of a surprise, thereby making this a long in my opinion.

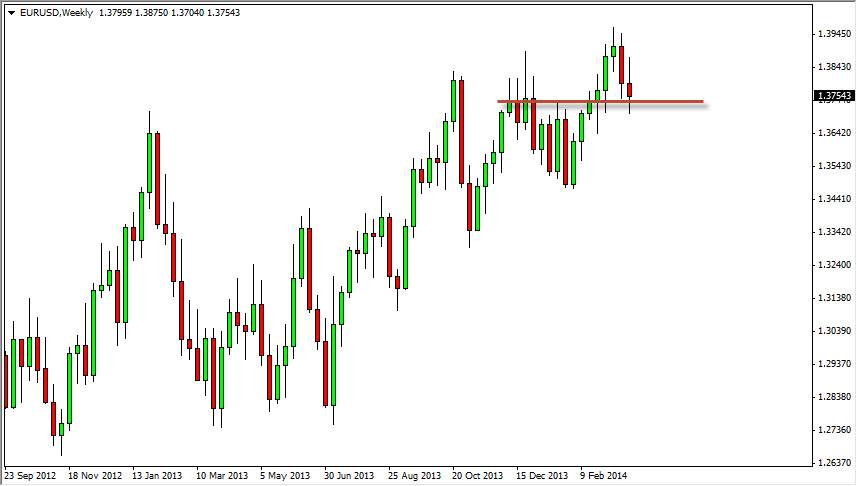

EUR/USD

The EUR/USD pair tried to rally initially during the week, but found enough downward pressure above to push things back around and form a shooting star. The shooting star of course is very negative sign, but I see a significant amount of support below as well. Quite frankly, I don’t see a reason to be involved in this market right now as there is just simply far too much in the way of noise. If you want to be involved in the Euro, I would suggest reading the paragraph above again.

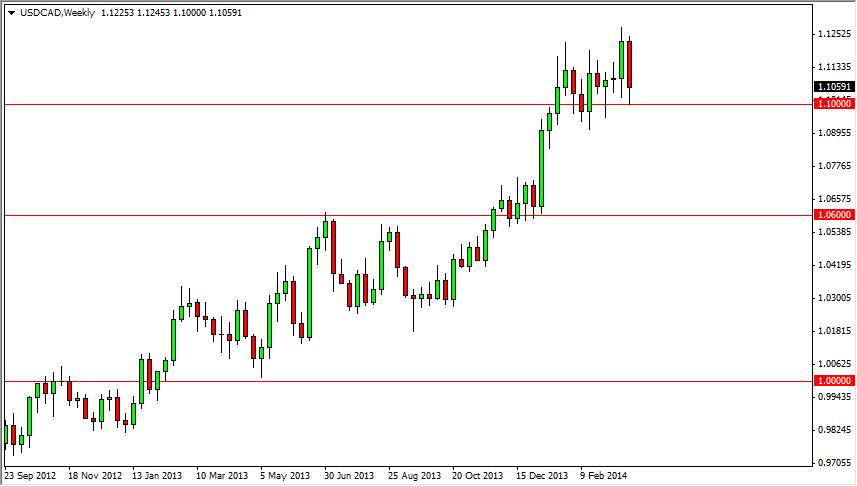

USD/CAD

The USD/CAD pair fell during most of the week, but you can see found enough support at the 1.10 level to stay somewhat afloat. I believe this market is going to continue to consolidate, and that there is still a significant amount of buying pressure underneath. Nonetheless, I don’t really see a reason to be involved in this pair from a longer-term, so quite frankly I believe that this will be the realm of range trading type of traders, and long-term traders will struggle to make any real money here. Regardless though, I do see the potential for a longer-term move higher.

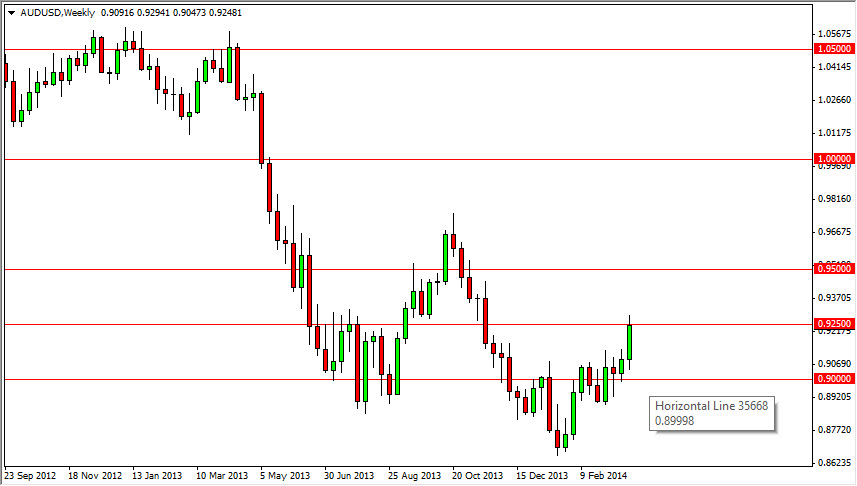

AUD/USD

The AUD/USD pair had a very strong showing over the last week, initially falling but finding enough support to shoot all the way up to the 0.9250 level. Because of this, we know are at an area that could be very interesting. If we can get above the highs from last week, I think this market goes to the 0.95 level, albeit in a somewhat choppy manner. However, if we get some type of negative weekly candle here, that would lead to a very comfortable selling position as far as I can tell. For myself, I’m not placing any long-term Australian dollar trades as we, but I will most certainly be paying attention to what we have at the end of the day on Friday.