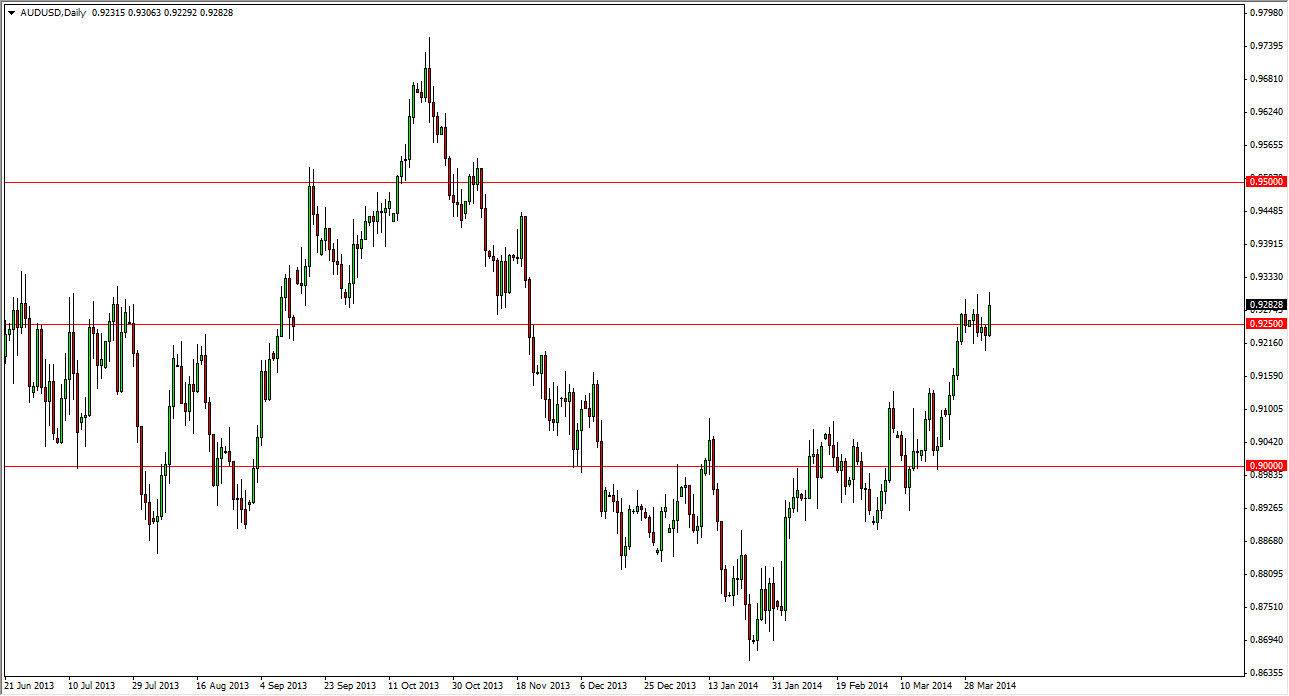

The AUD/USD pair rose during the session on Friday, but failed to break out of the reason consolidation that we’ve been stuck in. It doesn’t really matter though, it appears to me that the hammer from the Thursday session was a little bit protective, and as a result it’s only a matter of time before we do in fact free ourselves from this consolidation area. I would consider that to be gone if we can get above the 0.93 level on a daily close. At that point in time, I believe that the market would eventually head to the 0.95 handle.

On the other hand, we could in fact break down below the hammer from the Thursday session, creating a “hanging man.” That of course is a very bearish sign, and I believe at that point in time we would probably head to the 0.91 handle, as there is a significant amount of clustering in that general vicinity.

Gold broke out to the upside on Friday, could be a predictive indicator for the Australian dollar.

The gold markets did very well on Friday, and as many of you know already, the gold markets do tend to follow the Australian dollar and vice versa. Because of this, that could be a little bit of a predictive indicator for what’s going to happen in the Aussie dollar market, and quite frankly a breakout from here based upon the way the chart has been behaving would exactly be a stretch of the imagination either. Granted, I see a significant amount of clustering and resistance just above, but at the end of the day it’s really nothing that the market should be able to go through and head towards the 0.95 level over.

It really isn’t until we get below the 0.89 handle that I would feel comfortable selling this market for any real length of time. At that point time I would consider the Australian dollar broken again, but quite frankly the selloff has been pretty brutal and a move higher would exactly be out of the realm of possibility based upon that alone.