The AUD/USD pair fell during the session on Monday, but found the 0.95 level to be supportive enough to keep the market somewhat afloat. This candle doesn’t necessarily look strong, but it does show that there are at least a significant amount of buyers below, and it allows me to feel little bit better about going long of the Aussie dollar, not to mention the fact that the New Zealand dollar looks supportive as well, and as a result I believe that the Aussie and the New Zealand dollar both will continue to go higher.

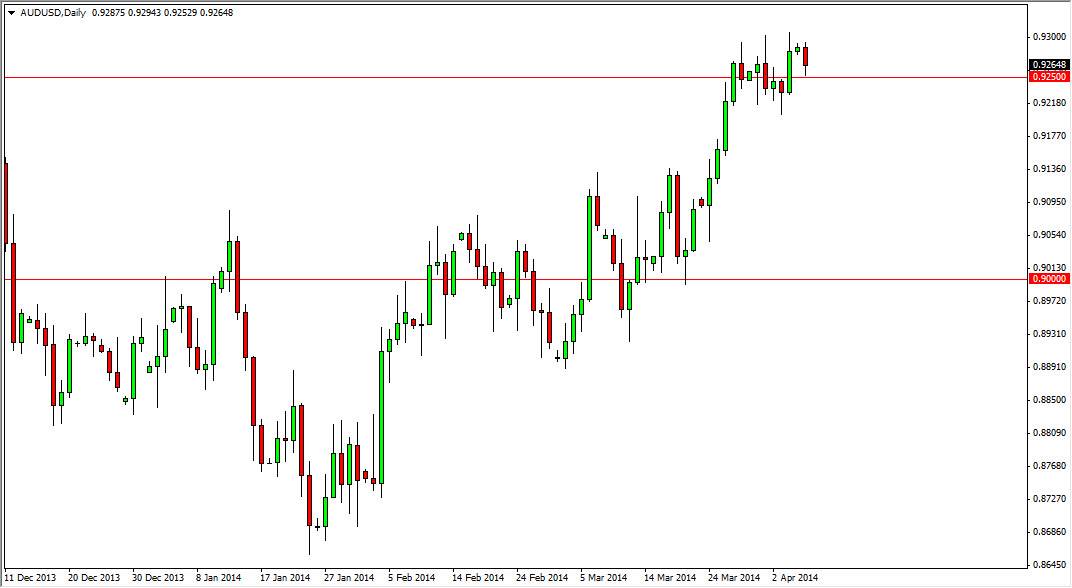

Pay attention to the gold markets as well, because it certainly can lead the Aussie dollar either higher or lower. However, I believe that the 0.92 level is going to continue to be supportive as well, but if we can break above the highs from the Friday session, this market should continue to go much higher, probably heading to the 0.95 handle, which of course is the next large, round, psychologically significant number

Parabolic moves tend to consolidate from time to time, or take a rest.

When you have a parabolic move like we’ve seen recently, it’s very common to see the market go sideways or just simply grind sideways to take a rest. After all, a lot of buyers are already in the market. That being the case, I believe that a break of the top of the Friday session at the 0.93 level signifies that we will go higher.

The shape of the candle is somewhat supportive, although I am the first to admit that we could very easily drift a little lower from here, although the line on the chart seems to have held up for the time being. If we do somehow breakdown below the hammer from a few sessions ago, this market would more than likely fall from there were in a rather quick manner. However, I see the 0.91 level as being an area where we would begin to see support, probably extending all the way down to the 0.90 handle.