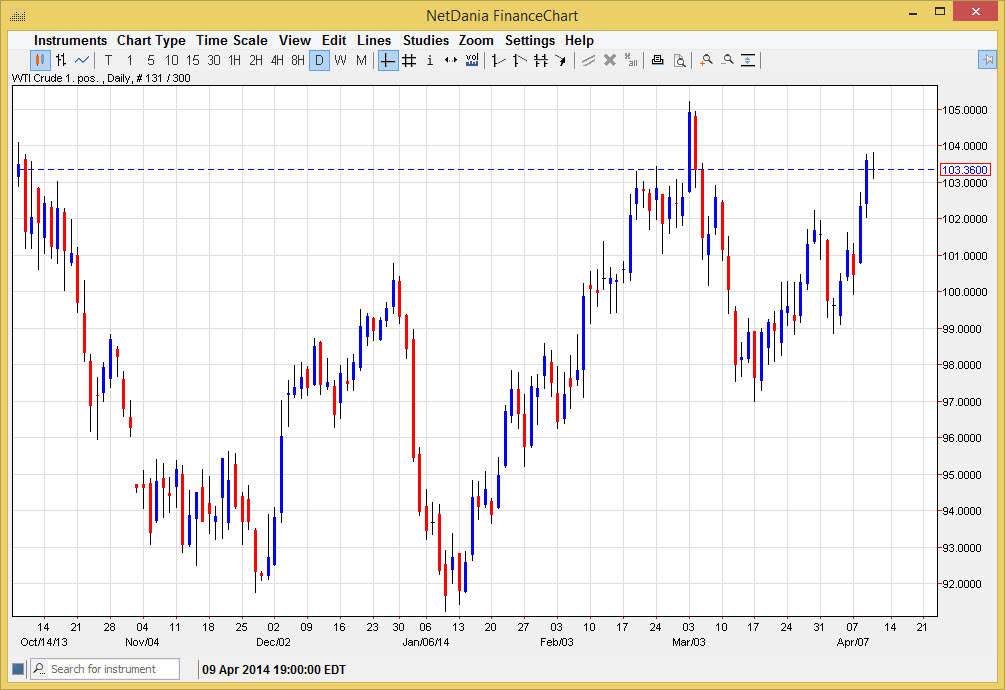

The WTI Crude Oil markets went back and forth during the session on Thursday, meandering just below the $103.50 range. The fact that we formed a very neutral candle suggests to me that perhaps we will get a little bit of a pullback, which isn’t necessarily a bad thing. After all, the last several sessions of been very parabolic and we do want to see a bit of a momentum building attitude in this marketplace to go higher. After all, what a move is to sharp, it very often will fall flat when it runs into serious resistance. I believe that the serious resistance in this market is at the $105 level, so I want to see this market struggle a little bit over in other words, simply look for more buyers to keep the momentum going higher.

I believe that there’s a significant amount of support down at the 102 level, and needless to say many places below. In fact, I am essentially “buy only” of this market until we get below the $97 level, something that I don’t expect to see anytime soon. With that, this market could be one of the more interesting ones going forward, and now that we have broken above the resistance at the $103 level, I think that something significant has truly happened.

Longer-term buy.

I believe it is the longer-term buy-and-hold type situation if you have the wherewithal. Don’t get too hung up on the idea of being in the futures markets though, because the tick value is so high. You may want to try the CFD market, or even the options markets. After all, you have the ability to define your risk ahead of time, as options are a great alternative when you don’t necessarily have the timing down. The CFD market allows you to trade much smaller increments, and as a result the everyday trader will have more of a chance. For those of you in countries that do not offer CFD trading, you may want to consider an ETF. For example, in the United States there are several the follow the WTI market. As a general rule, oil based service stocks will follow the price of the commodity also. There a lot of different ways to play this market, so don’t get hung up on the most obvious. Nonetheless, I do expect bullish momentum to continue over the longer term as the market more than likely will head to the $110 level.