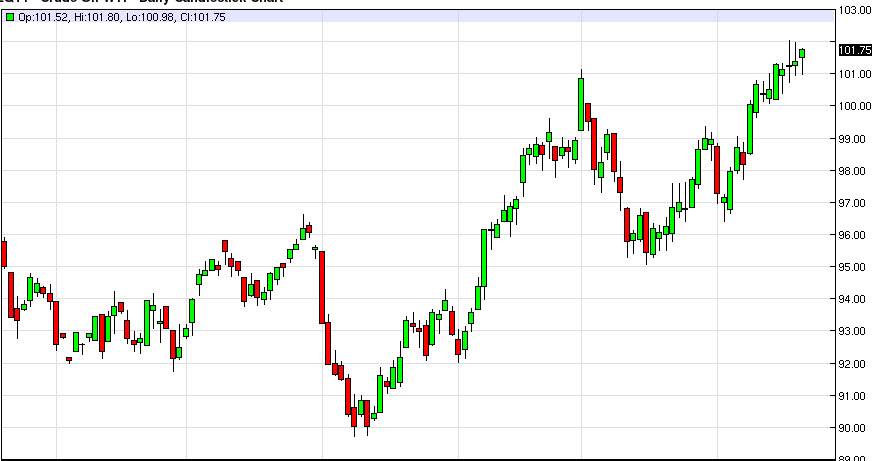

The WTI Crude Oil markets fell initially during the session on Monday, but found the $101 level to be supportive enough to push the market back around and form a hammer. This hammer suggests to me that the market is in fact going to continue going higher, and because of that I am a buyer on a break of the highs which is roughly $102, which of course was the highs of the last two sessions as well. So, I believe at that point the market should grind its way up to the $105 level, which has been a target for me for some time now anyway.

I also believe that pullbacks at this point time will find plenty of buying pressure all the way down to the $95 level given enough time, and at least the $100 level. In fact, I think that’s what the candle for the session on Monday shows, that there are buyers down below waiting to pick the market up every time it falls.

Far too many headlines waiting happen to sell this market.

I believe that there are far too many headlines out there waiting to happen in order to sell this market. After all, there are a lot of concerns with Russia and the Crimean Peninsula, which of course has a bit of an effect on the oil markets as Russia is an exporter of the commodity. While the WTI Crude Oil market doesn’t necessarily rely made directly on Russia, the fact that it drives of the Brent prices as well as other heavier crudes has a knock on effect in this market place as refiners will switch over to WTI when it’s easier to get.

Going forward, I fully anticipate that this market continues to go higher, thereby making pullbacks buying opportunities, and quite frankly you can see that ever since we flipped the year on the calendar, this market has essentially been in a strong uptrend as buyers keep stepping into supported. Selling is not an option at this point in time as far as I see.