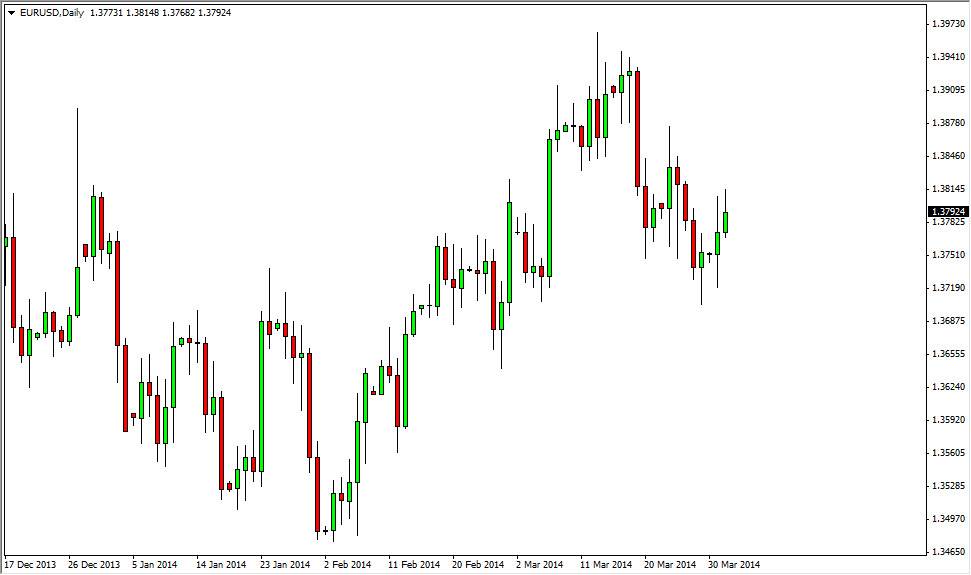

The EUR/USD pair broke above the highs from the Monday session on Tuesday, but as you can see found hanging onto the gains to be a bit difficult by the end of the day. We didn’t quite form a shooting star, but this candle suggests to me that we are still looking at a market that is going to struggle to go much higher. Yes, it may eventually do so, but I feel that this market is going to chop around in the process. Quite frankly this is one of the least interesting Forex pairs to me right now.

I believe that the 1.37 level on the downside is supportive enough to keep the market somewhat afloat. If we get below there, I believe that this market does in fact fall apart inserts heading toward the 1.35 handle. A move down to that level could be rather quick, if we do break down enough.

Expect volatility to continue.

I can make an argument as to why this market my go higher, but the problem is that there is resistance of the 1.3850 level which is significant, and that will certainly slow the market down. Above there, I see the 1.39 level as being resistive, and extending all the way to the 1.40 level, which is a major and large psychologically significant number obviously. Because of this, I find it very difficult to go long of this market as well, and as a result I have to ask whether or not it’s even worth risking your trading capital on?

That being said, pay attention to whether or not the Euro rises or falls against the US dollar. This could be used as a tertiary indicator in a lot of different EUR related pairs, such as the EUR/JPY pair. That is a market that looks like it’s trying to break out to the upside, and by paying attention to the Euro against the US dollar as it is the bellwether for the strength of the two currencies, can give you an idea as to whether or not you should be buying that pair. If the Euro shows any signs of strength, look to buy it against other currencies.