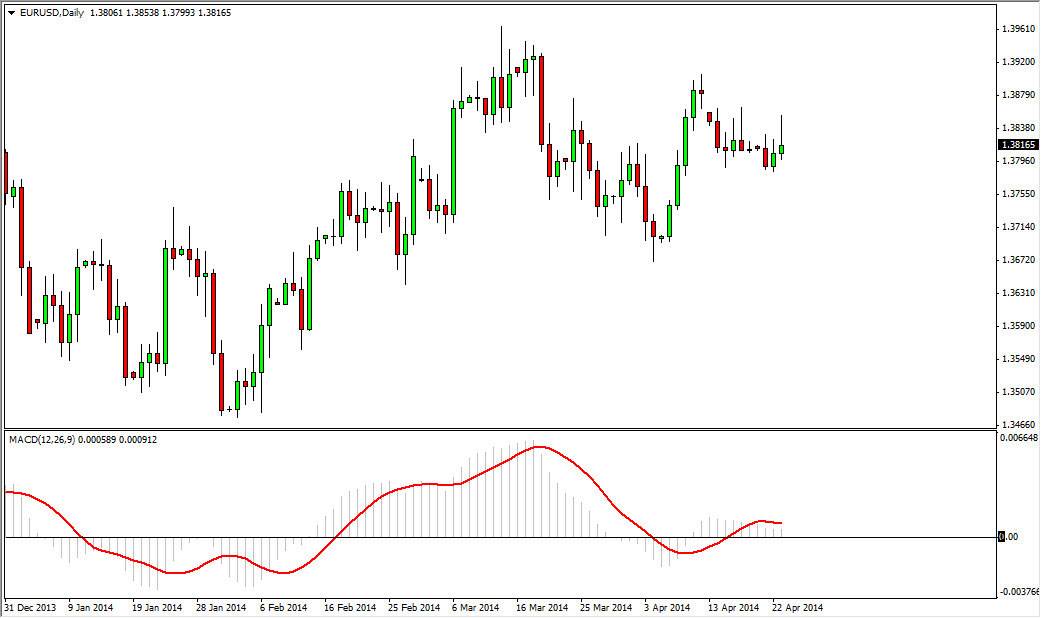

The EUR/USD pair tried to rally during the session on Wednesday, but found the area above the 1.3850 level to be resistive enough to push the market back down. With that, it appears that the market is starting to run out of strength here, and after the parabolic move we had a couple of weeks ago, that’s not exactly a huge surprise. The fact that we formed a shooting star of course is bearish in its own right, and the fact that the MACD is starting to wane suggests that perhaps we are starting to run out of momentum.

The biggest problem I see is that the 1.38 region is pretty supportive. With that, there is a significant amount of noise just below, so it’s difficult to start selling with any confidence at this point in time. Granted, if we break down below the 1.38 handle significantly, there’s really nothing to stop us from falling down to the 1.37 candle, with the exception of the fact that there is just a lot of noise. I would anticipate a lot of support near the 1.37 level as Euro bulls start reentering the marketplace.

A move to the upside would be easier to stomach.

Although it is most certainly against a massive downtrend line from the monthly chart, I still think that a move higher is probably going to be easier to deal with, basically because it would break through so much resistance that you would almost have to step in and start buying. I’m not necessarily anticipating this, but I do recognize that it would not only break this larger downtrend line, but it also would go against several wicks from the last several sessions. Because of that, I would be very interested in going long above the 1.3950 level, or even better yet above the 1.40 level, as it would signify a potential longer-term buy-and-hold type of situation in this market, something that we haven’t seen in a while. In fact, for those of you who weren’t trading seven years ago, it might be hard to believe that it used to be a simple as buying the Euro every time it fell. If we get above the 1.40 level, I think we may see that again.