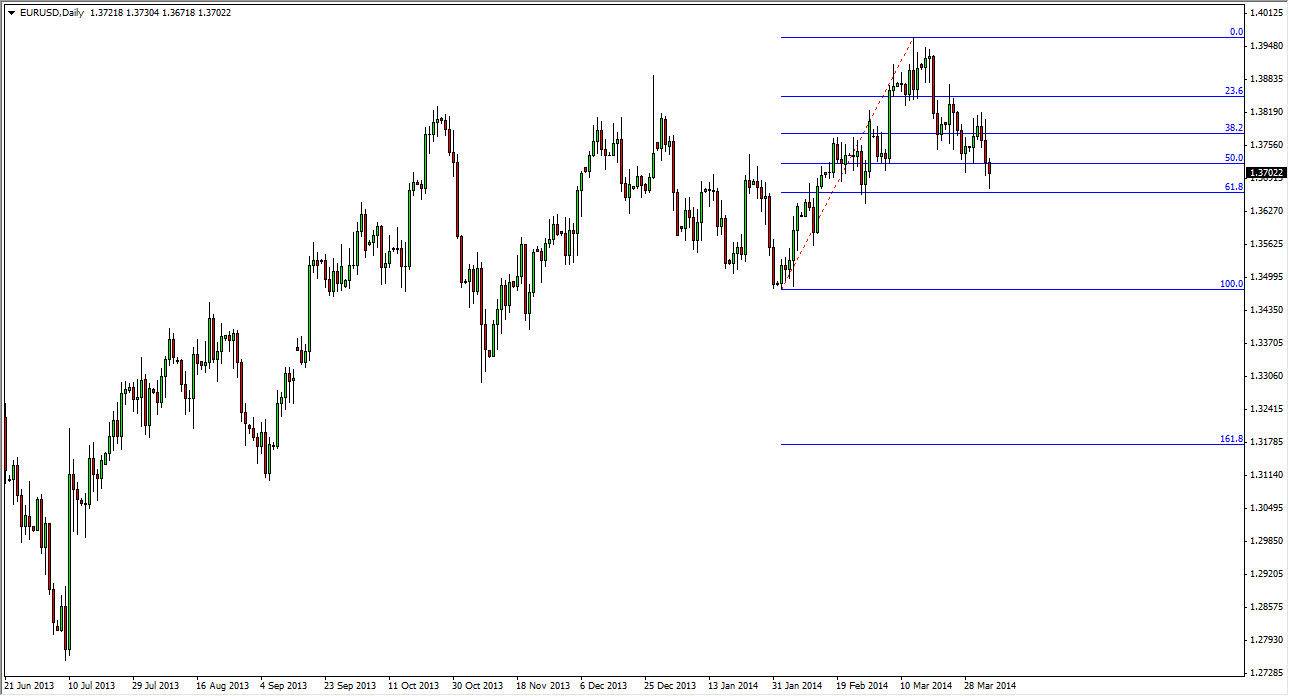

The EUR USD pair spent most of the day selling off during the Friday, but as you can see found enough support below to make the market pop back above the 1.37 handle. With that, we formed a nice-looking hammer, which is focused just below the 50% Fibonacci retracement level. In fact, the bottom of a hammer is right down at the 61.8% Fibonacci retracement level, what is often thought of as the “Golden ratio.” Because of this, I like the idea of buying here on a break of the top of the hammer, although I do recognize that the pair will probably struggle from time to time on the way back up.

Whether or not this market can reach the highs again is a completely different question, but when you look at the totality of the market in the way it has been moving, you have to recognize the fact that it has been grinding higher over time. That’s the real key word though: grinding.

Try not to make too much sense of this.

To be honest, I can make too much sense of this pair but recognize the fact that over the longer term it does tend to gain in value. With that, this hammer makes sense to me, even though I don’t necessarily believe that the Euro should strengthen over the longer term. It doesn’t really matter what I think though, all that matters is where the market ends up. Remember, there is no “right way” as far as the value of the currency is concerned. The market will do whatever it wants to do, and that’s something you simply have to deal with.

I believe that if we break down below the bottom of this hammer though, that would in fact be a very bearish sign. I would fully anticipate heading back to the 1.35 handle, and I would also anticipate that taking a while. It really doesn’t matter what happens in this market, because any move is happening from here is going to be choppy to say the least, and therefore require patience.