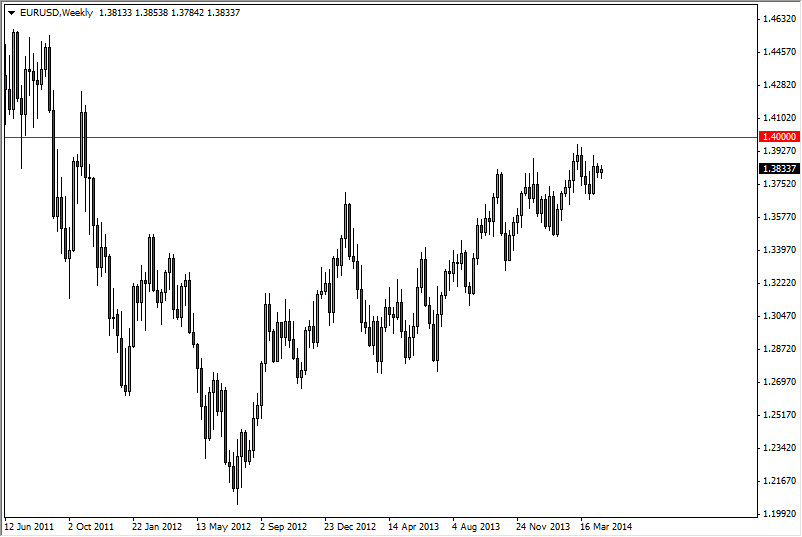

The EUR/USD pair has been in a gradual grind higher over the last couple of years. However, it’s been a very choppy pair in general, so anyone expecting some type of easy trade is probably deluding themselves. As we approach the 1.40 level, I can see that there is a significant amount of resistance at this large, round, psychologically significant number.

On the other hand, you can see that the grind higher has been rather relentless, albeit at a snail’s pace. With that, I think that we will see continued bullishness, but I wouldn’t look for some type of easy trade. It would quite frankly be much more helpful if there was a positive swap in this pair, and depending on the broker that you use, you may or may not have it. However, it’s not going to be that big of a swap, so quite frankly I do not see the usefulness of trading this pair at the moment.

However, a breakout would change everything.

I think if we get a breakout above the aforementioned 1.40 level that would change everything in this pair. I think at that point time we would head to the 1.45 handle first, although there is a cluster in the way that could cause the market to continue to be as choppy as it has been over the last two years. Nonetheless, I do think that there is a significant chance of this happening. On the other hand, if we break down below the 1.37 level, we could in fact see a significant pullback. That pullback could be used as value, as I see far too much in the way of support at various levels all the way down to the 1.28 handle to get overly bearish at any point.

I personally believe that the month of May will offer buying opportunities, but it will be of the short-term variety. Make plans to pay attention to breakout above 1.40, but at the end of the day I believe that most of this market’s opportunities will be for day traders.