EUR/USD Signal Update

Last Thursday’s signals were not triggered and expired as the price never reached either 1.3751 or 1.3861.

Today’s EUR/USD Signals

Risk 0.75%

Entry must be made before 5pm London time today.

Long Trade 1

Go long following confirming bullish price action on the H1 chart after the first touch of 1.3751.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3790.

Remove 50% of the position as profit at 1.3790 and the remainder of the position at 1.3835.

Short Trade 1

Go short following confirming bearish price action on the H1 chart after the first touch of 1.3861.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even at 1.3836 and take 50% of the position as profit.

Exit the remainder of the position at 1.3760.

EUR/USD Analysis

For the last two weeks this pair has shown exceptionally low volatility. It has been extremely range-bound and waterlogged. It was surprising that we did not get some kind of breakout towards the end of last week. Now we approaching the non-farm payroll data on Friday, things are also likely to be pretty quiet before then, so there is no end in sight to the feeble ranging behaviour.

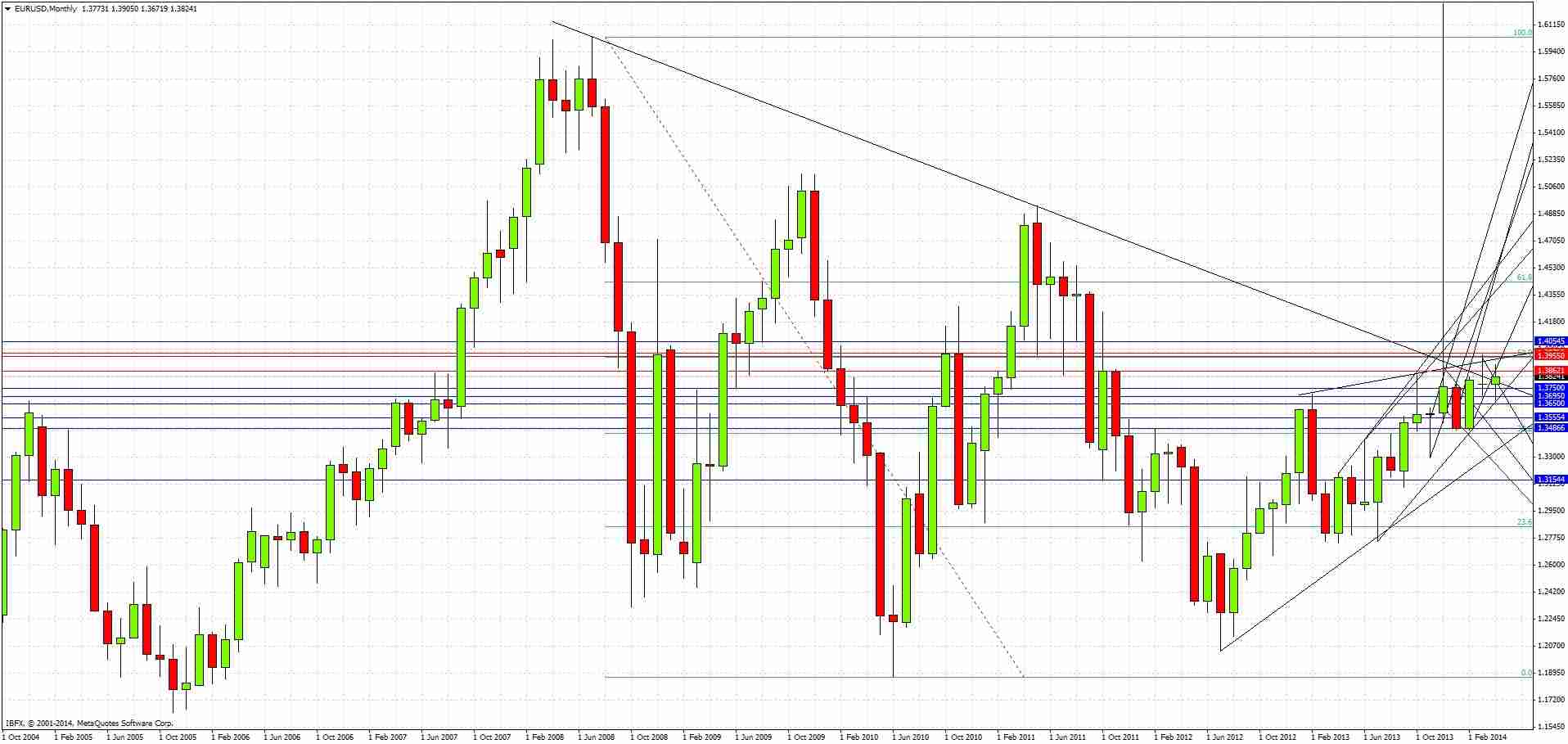

One reason why this pair has no direction is likely to be that it is trying and failing to make a decisive break above a multi-year bearish triangular trend line, as shown in the diagram below:

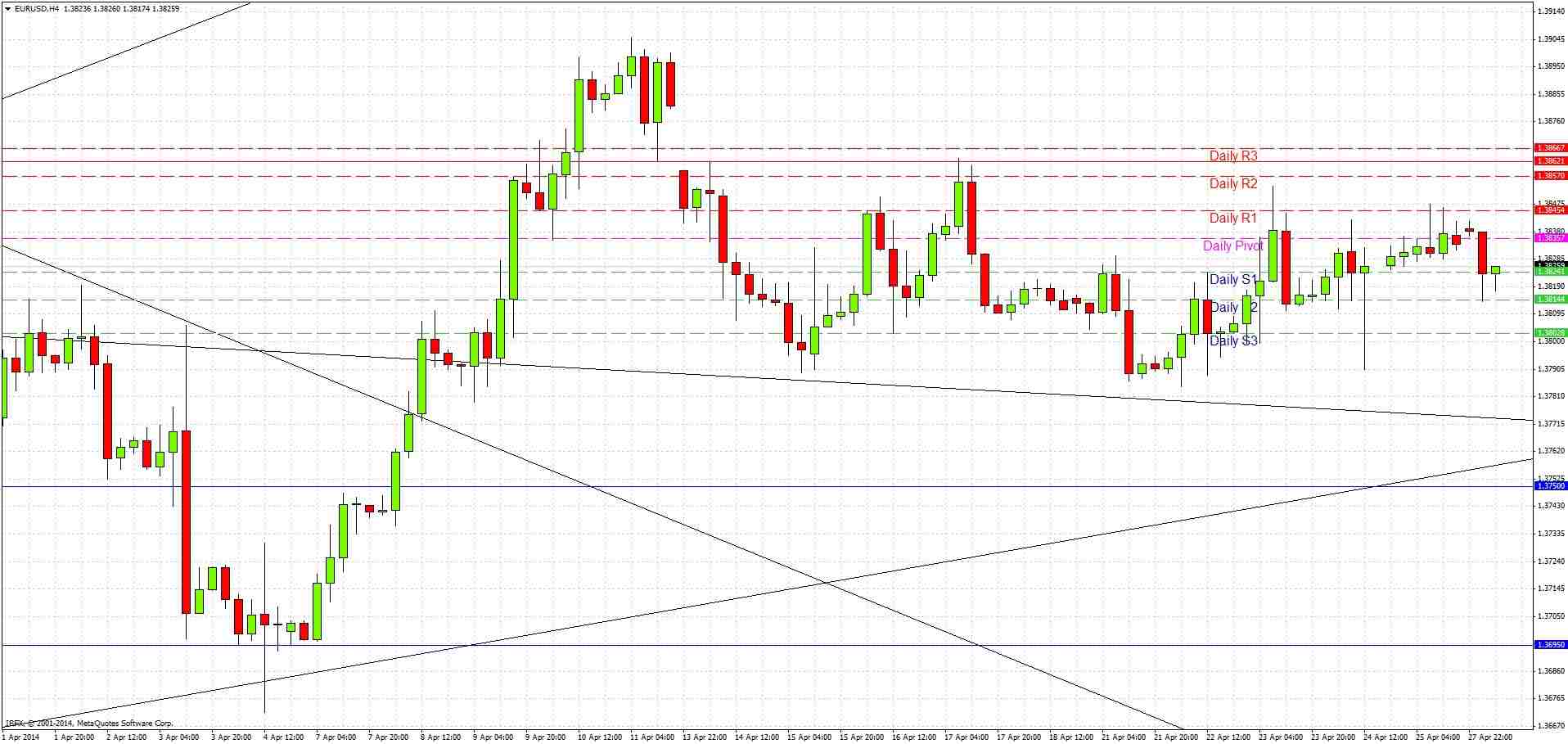

So we remain stuck in a range between about 1.3800 and 1.3861.

Above we still have the flipped resistance at 1.3861 that should be a good level at which to look for a short trade.

Below us we still have the flipped support at 1.3751 which is also fairly confluent with two significant trend lines. If the price gets down here it is likely to be a good supportive area at which to look for a long.

Unfortunately it is likely to be a very quiet day today so it may well be that neither of our levels are touched during the London session.

There is no high-impact news due today for the EUR. At 3pm London time there will be a release of US Pending Home Sales which could affect the USD. It is likely to be another quiet day.