EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

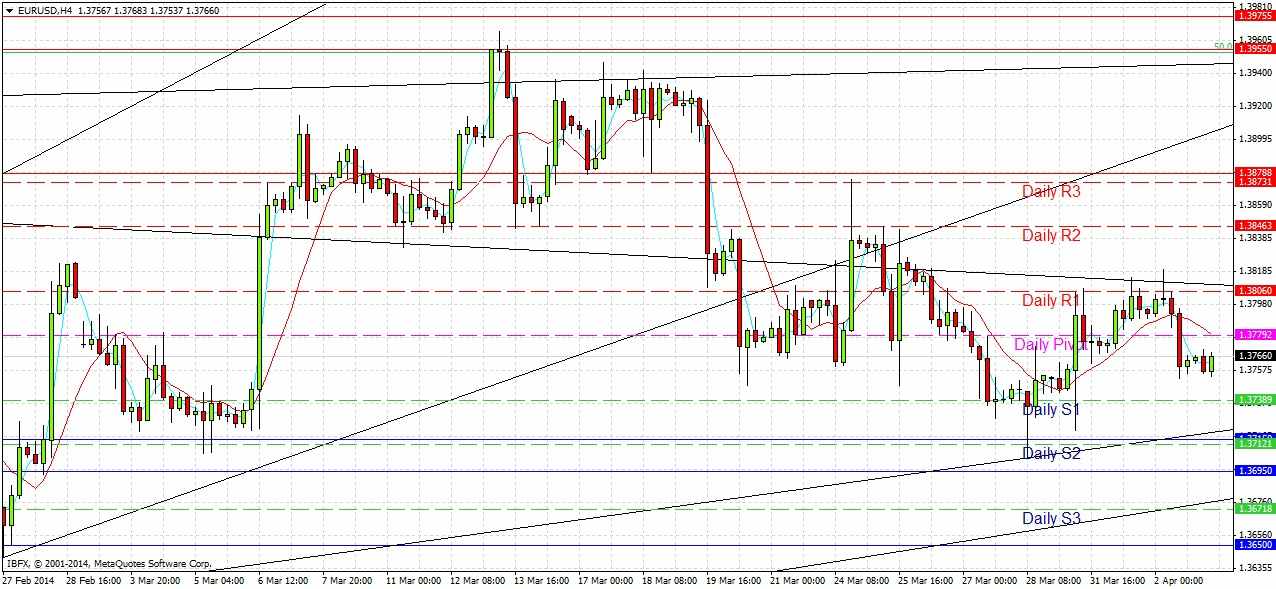

Today’s EUR/USD Signals

Risk 0.50%

Enter before 5pm London time.

Long Trade 1

Long trade if confirmed by H1 price action at 1.3715.

Put the stop loss 1 pip below the swing low.

Adjust the stop loss to break even when the trade has reached 30 pips of profit.

Take off 50% of the position as profit at 1.3760 and leave the remainder to run.

Short Trade 1

Short trade if confirmed by H1 price action at 1.3878.

Put the stop loss 1 pip above swing high.

Adjust the stop loss to break even when the trade has reached 25 pips in profit.

Take off 50% of the position as profit at 1.3830 and leave the remainder to run.

EUR/USD Analysis

Yesterday printed a bearish engulfing candle that in itself suggests a near-term move down to the bullish trend line at about 1.3715. However, we are going to get several high-impact news releases for both sides of this pair later today and tomorrow, so it is probable that the next move will be driven by sentiment first and technical factors second. It seems also that the 1.3760 area is acting as support right now.

Probably nothing much will happen until about 12:30pm London time, after which sudden spikes to 1.3715 and 1.3878 could provide opportunities to counter, or may perhaps change the picture to the extent that the levels will blow through.

The bearish trend line currently above us at 1.3810 seems to have come into play again.

There is no high-impact news due today before 12:45pm London time when there will begin important releases for both currencies, so it likely to be quiet before then. At 12:45pm there will be the announcement of the ECB Minimum Bid Rate followed by a press conference at 1:30pm. The President of the ECB will speak at 3pm. Regarding the USD, the Trade Balance and Unemployment Claims statistics will be released at 1:30pm, followed by the ISM Non-Manufacturing PMI at 3pm. It might well be a pretty volatile afternoon.