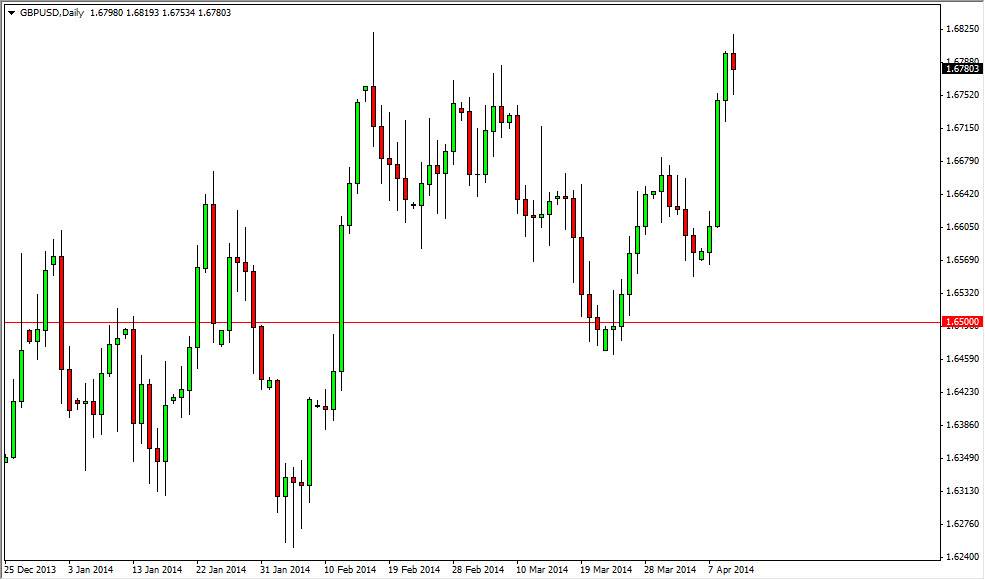

The GBP/USD pair fell during the session on Thursday, after initially trying to rally. The 1.68 level has offered enough resistance to keep the market down the bed, but at the end of the day we ended up forming a hammer. This hammer of course suggests that the market wants to go higher, and that momentum is starting to build up yet again. The meantime, it’s likely that we will struggle a bit in this general vicinity, but think of the old beach ball analogy: when a market struggles at a particular level couple of times, eventually the breakout becomes very violent. It’s like holding a beach ball underwater, and suddenly releasing it. It breaks the surface with a massive amount of momentum, and rocket straight up into the air. I believe that the GBP/USD pair could be capable of this.

Regardless, I still have a longer-term target 1.70, and maintain that we will eventually hit that level. Looking at the chart recently though, it has been a bit on the parabolic side. Because of this, I would not be concerned about a breakdown at this point time and would look at it as a potential buying opportunity.

Continued momentum to the upside given enough time.

I believe that this market will find plenty of support at levels below, the 1.67 level being the first one. If we get down below there, I believe that the 1.66 handle is also supportive, and that the 1.65 level is the absolute “floor” of this market. I have a hard time believing that we get below the 1.65 level, and actually believe that the farther we, the better off it’s going to be. After all, we need a lot of traders to come back into the marketplace and help build momentum to the upside in order to get that breakout that we want to see. That breakout will be one of the easier trades to take, and I would be very interested in doing so. With that, I have no interest in selling this market at the moment, and wouldn’t even begin to fathom that concept until we got down below the 1.65 handle at the very least.