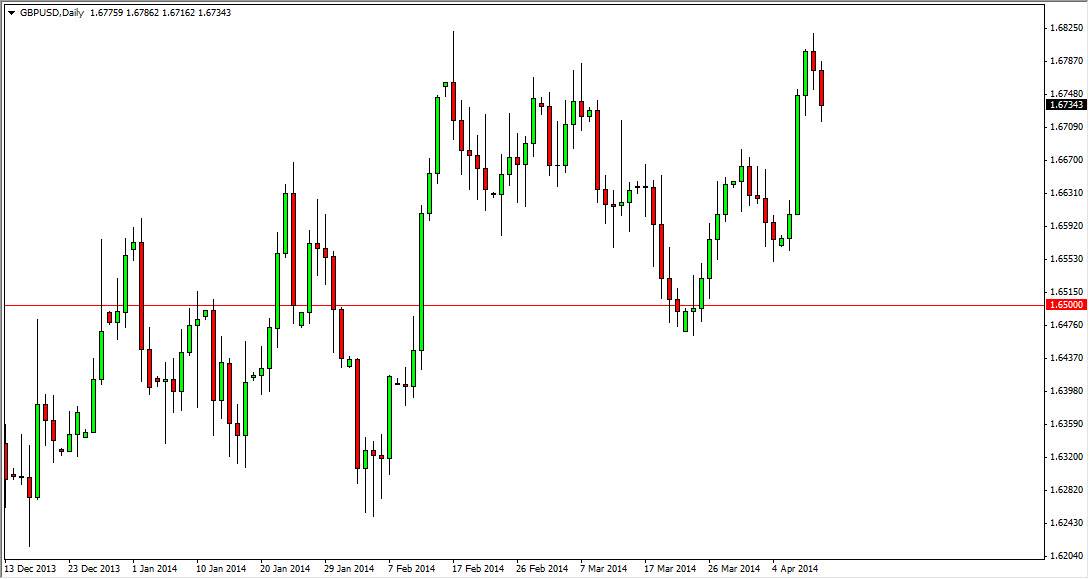

The GBP/USD pair fell during the session on Friday as you can see, but remains above the 1.67 level, an area that I believe will begin significant support based upon the previous consolidation area that we had been involved in during February. I also think that there’s plenty of support all the way down to the 1.65 level, so quite frankly I am in “buy only” mode.

This is a market that had been consolidating in a fairly wide range recently, withdrawals most attention for me is the fact that we have this massive and impulsive candle from Tuesday that simply looks like it’s sliced through a lot of stop loss orders. That’s okay though, that just simply tells us that there is a significant amount of buying pressure underneath, and that the consolidation area could very well end up being a simple rest before the next leg higher. That of course is common, as consolidation typically turns into continuation.

Bearish candle, but quite frankly I’m not impressed.

The berries candle from the Friday session of course does show weakness, but quite frankly am not impressed. After all, we couldn’t even sliced through the first handle below, and that to me suggests that there isn’t any serious amount of selling pressure, and that it’s possible that this was simply a matter of running out of forward momentum, or perhaps just closing out trades before the weekend. Nonetheless, I do think that it’s only a matter time before we break out to the upside, so quite frankly I’m comfortable buying this pair anywhere in this general vicinity, and based upon just about any timeframe. It really isn’t until we get below the 1.65 level that I begin to worry about the trend of this market, something that does not look very likely to happen at this moment.

If we do get above the 1.68 level, I believe that it’s only a matter time before we test out the next natural resistance barrier, the 1.70 level. Up there, we will probably see quite a bit of resistance, but ultimately I think it gives way as well as the British pound continues to climb.