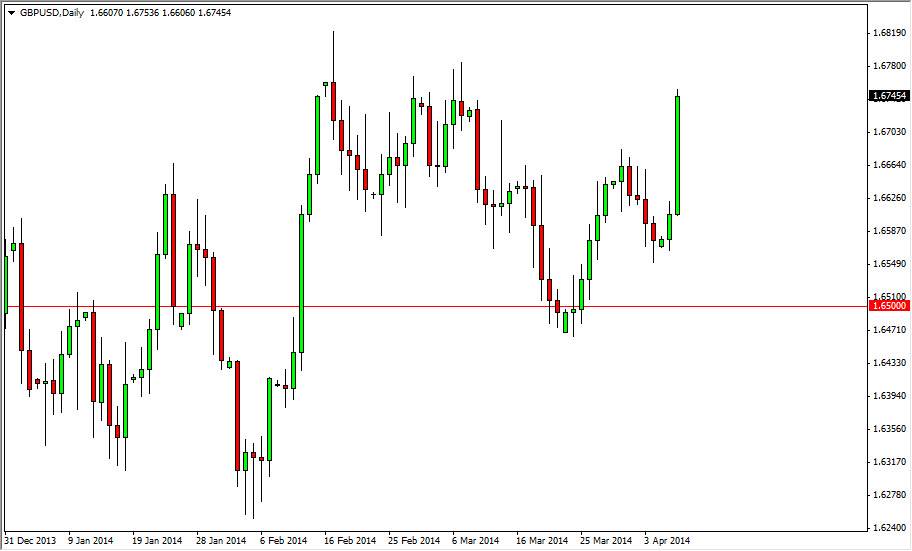

The GBP/USD pair shot straight up during the session on Tuesday, acting much like a rocket taking off. That being the case, it appears that we have broken above a couple of minor resistance areas, which of course shows that there is a significant amount of buying pressure underneath. We managed to break above the 1.67 handle, which I saw as more or less a minor level, but was it one that mattered. The fact that we broke above there and crashed into the 1.6750 level tells me that there is plenty of bullish attitude underneath. If we can get above the 1.68 level, I believe at that point in time that the market heads to the 1.70 level, which is the longer-term target.

Any pullback at this point in time it to me suggests that we are going to have support below that should attract buyers. After all, this pair has been rather bullish over the longer term, although the last couple of months of been rather indicative of consolidation

Bullish overall, buy only.

I believe that this market is bullish overall, and therefore I have no interest in shorting this market. I believe that every time this market falls, there will be plenty of support underneath in order to keep the market higher. I believe that short-term charts will probably be the way to go, as ultimately this market will break out and head to the 1.70 level, but it should be a difficult trade to hang onto unless of course you have a longer-term outlook. I believe that ultimately the buyers will win out, and that the impulsive candle during the session on Tuesday shows that there is buying pressure and that the market is trying to break out overall. It simply gives the impression of what the market truly feels.

I see no way to sell this market at all until we get below the 1.65 handle, which I feel is the “floor” in this market. Because of this, I am not even consider in selling, and wouldn’t even think about it until we get below that level on at least a daily close, possibly even a weekly close.