GBP/USD Signal Update

Yesterday’s signals expired without being triggered.

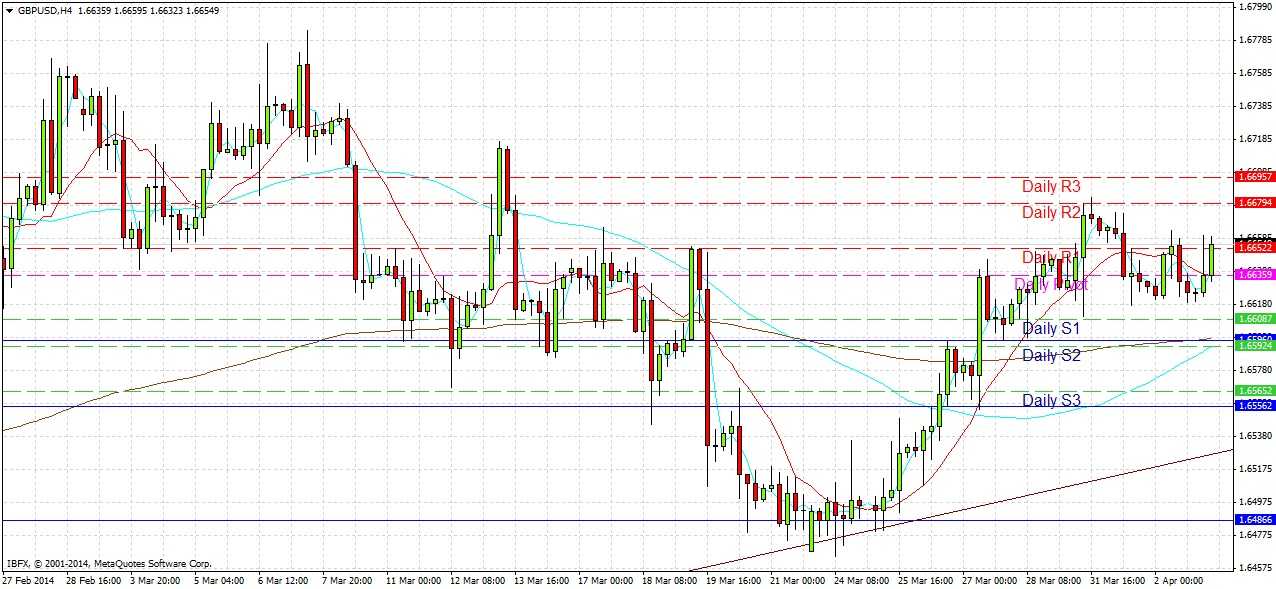

Today’s GBP/USD Signals

Risk 0.50%

Enter before 5pm London time.

Long Trade 1

Take a long trade if confirmed by H1 price action at 1.6596.

Place the stop loss 1 pip below the swing low.

Adjust the stop loss to break even when the trade has reached 20 pips in profit.

Take off 50% of the position as profit at 1.6530 or when the stop loss has been moved to break even if that occurs later.

Long Trade 2

Take a long trade if confirmed by H1 price action at 1.6556.

Place the stop loss 1 pip below the swing low.

Adjust the stop loss to break even when the trade has reached 25 pips in profit.

Take off 50% of the position as profit at 1.6590 or when the stop loss has been moved to break even if that occurs later.

GBP/USD Analysis

Yesterday’s daily candle was a second consecutive inside bar. This morning it looks like we are about to get a break out of this congestion to the upside. We have had new support levels printing below, which remain untouched, and of course we remain within a long-term bullish channel and have recently had a nice u-shaped bottom off the lower trend line.

A candlestick analysis of the higher time frames shows bullishness and it looks like the daily is turning bullish too.

The real question is probably how high we may go. We have high-impact news, especially concerning the USD, that will come out over the 2 days. The line of least resistance is definitely upwards so if the news is bad for the USD we are likely to get a strong move up. Technically, there will probably be resistance coming close to the key psychological level of 1.6750.

Regarding the GBP, there is the Services PMI data release at 9:30am London time. Later on there is a slew of US-related high-impact data, as well as EUR data which could have an impact on the GBP indirectly. The USD data releases are the Trade Balance and Unemployment Claims statistics at 1:30pm, followed by the ISM Non-Manufacturing PMI at 3pm. It might well be a pretty volatile afternoon.