GBP/USD Signal Update

Yesterday’s signals were not triggered and expired as the price never reached either 1.6753 or 1.6884.

Today’s GBP/USD Signals

Risk 0.50%

Entries must be made before 5pm London time today

Short Trade 1

Short entry following confirming strongly bearish price action on the H1 chart after a first touch of 1.6884.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even and take half the position as profit at 1.6820 and leave the remainder to run until 1.6760.

Long Trade 1

Go long following confirming bullish price action on the H1 chart after a first touch of 1.6750.

Place a stop loss 1 pip below the local swing low.

Take the risk off the trade when the price reaches 1.6784.

Take 50% of the position as profit at 1.6820 and half of the remainder of the position at 1.6880.

GBP/USD Analysis

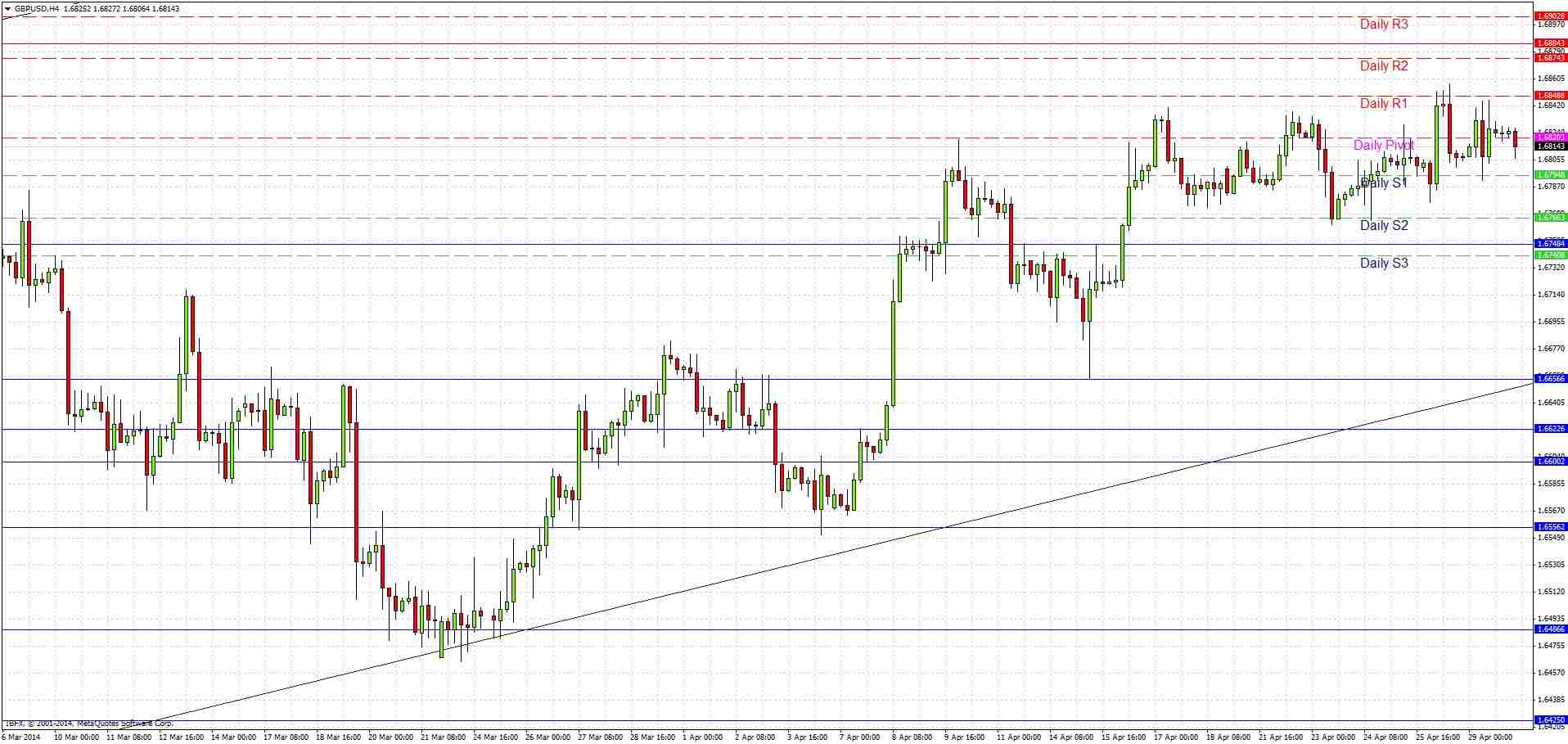

Yesterday printed a very slightly bullish near-doji inside bar. Looking at the H4 chart, we can see that the price has been forming a narrowing triangle this week from which it needs to break out. It will almost certainly take the USD data due later today to effect this, probably the FOMC statement due this evening after the London close.

Although all the long-term indications are bullish, we still have not been able to really make new highs so there should be some concern that we will experience a pull back. In spite of that, all the flipped bullish levels have held and we are well above the bullish trend line, so there is no real doubt that the bullish trend is still in effect.

There is no high-impact news due today concerning the GBP. Regarding the USD, at 10am London time there is the Eurostat CPI Flash Estimate. Later at 1:15pm there is the ADP Non-Farm Employment Change data, followed by Advance GDP 15 minutes later. Finally at 7pm there is the FOMC Statement. It is likely to be a fairly active day, at least in the sense of choppiness, but it may take the FOMC Statement to produce any real directional movement.