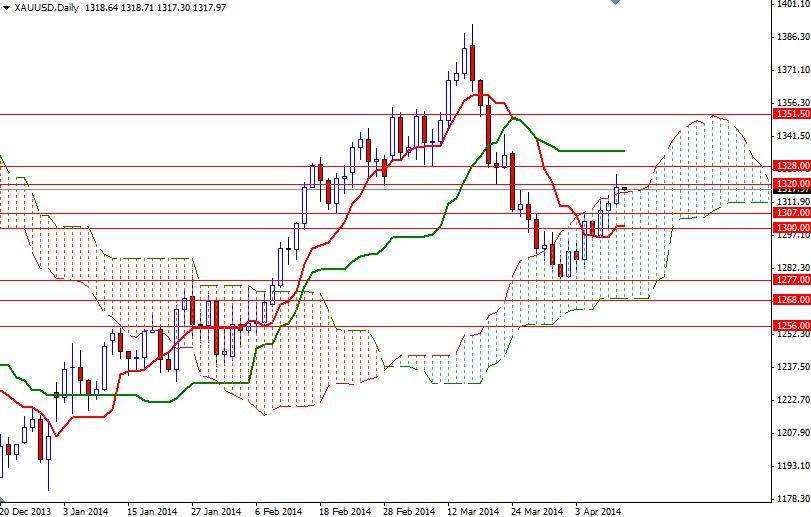

It appears that the XAU/USD pair paused its ascent during the Asian session today around the 1320 resistance level after three consecutive days of gains. Yesterday the pair traded as high as $1324.43 an ounce as weakness in the dollar and pullbacks in U.S. equities lured investors back to the perceived safety of gold. For 3 days in a row, gold prices have been making higher highs and higher lows, indicating that the bulls are gaining strength since that the pair bottomed out around 1277.

From a technical point of view, trading above the Ichimoku clouds on both the daily and 4-hour time frames gives an advantage to the bulls and because of that down side may be limited at the moment. However, as I stated last week, there is extra resistance between 1320 and 1328 so breaking through this barrier is essential for a bullish continuation towards 1351.50. If the bulls manage to climb and hold prices above the 1320 resistance level today, they might find another chance to test 1328.

Beyond 1328, resistance can be found at 1334.82 -where the Kijun-sen line (twenty six-day moving average, green line) resides on the daily time frame- and 1340/3. The key level to the down side is located at 1312.55. If the bears take over and pull prices below that level, I think we will be revisiting 1307 next. The bears will have to capture this camp in order to gain more strength and challenge the bulls on the next battlefield (1300 - 1297).