Gold prices fell yesterday as demand for the American dollar increased after the weekly unemployment claims figures and Philadelphia Fed’s survey beat forecasts. Data released by the Federal Reserve Bank of Philadelphia showed that its index of regional manufacturing activity climbed to 16.6 from 9.0 the prior month and the Labor Department's initial unemployment claims numbers came in at 304K, up from the previous week's 302K but well below expectations of 316K.

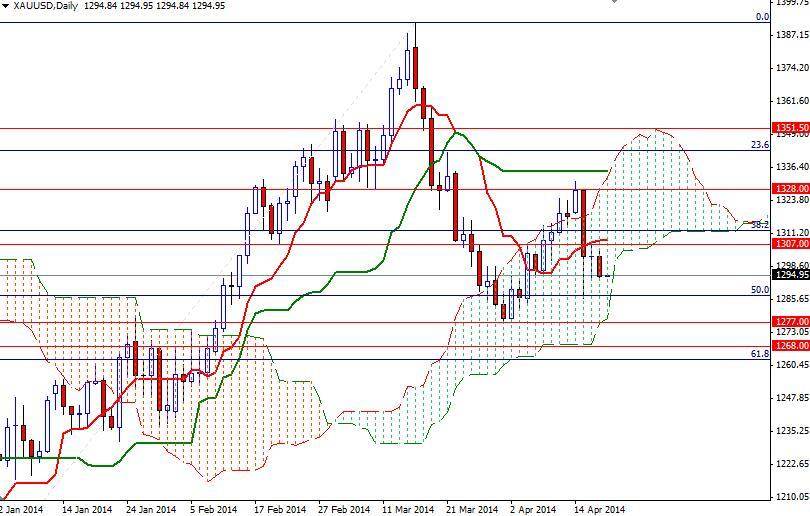

After the news, The XAU/USD pair broke below the 1296 support level and traded as low as 1293.08. In my previous analysis, I had told that the pair was going to feel bearish pressure in the near future unless it climbed above the 1312 level. This opinion is still valid but traders should also keep an eye on the 1293 level which has been acting as a temporary bottom recently.

If price closes below 1293, there is a strong possibility that the bearish trend will resume and the bears will be challenging the bulls at 1286 and 1277. If the 1293 level holds and the prices turn north, expect to see resistance in the 1304/7 area. The bulls will have to overcome the resistance at 1312 in order to sail towards the 1318/20. Gold trading is expected to be thin today as some financial markets will be closed for the Good Friday holiday.