Gold prices continued to fall yesterday as the bulls failed to overcome the resistance level at 1289. Gold traded as low as $1277.60 an ounce after figures released from the Institute for Supply Management showed that its index of manufacturing activity climbed to 53.7 from 53.2 a month earlier. Recently the pair has been trying to build some type of base just above the 1277 level and because of that I will be keeping an eye on this support.

Today the gold market remains steady during the Asian session as most investors are waiting for the ADP jobs report (today), ECB policy announcements (tomorrow) and non-farm payrolls figures (Friday). After two days of consecutive losses, holding above 1277 is positive for gold prices. However, while we have bearish pressure from strong equities markets, low inflation expectations worldwide and improving U.S. economic data, demand for the precious metal as an alternative investment will remain subdued.

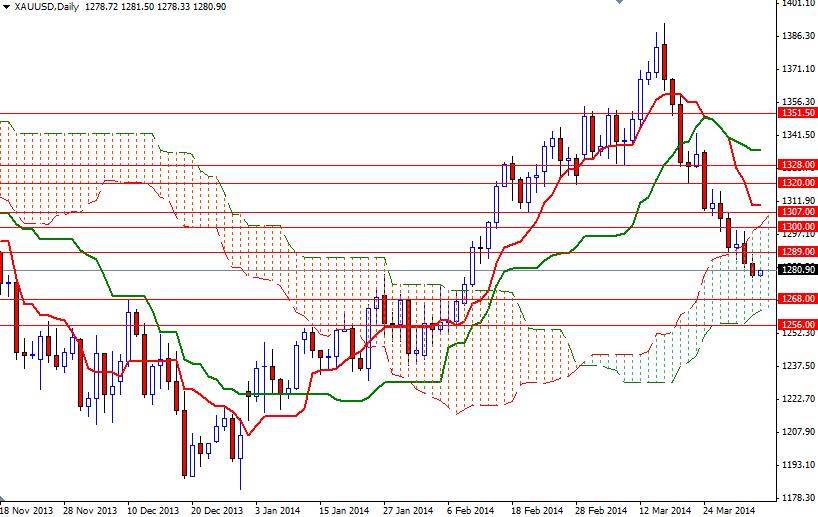

Technically, trading inside the Ichimoku cloud on the daily time frame indicates that the area between 1307 and 1263 will contain the market in the short term. From an intra-day perspective, I think the pair has to push its way through the 1289 resistance level in order to gain some traction. If the bulls manage to break and hold above that level, it is technically possible to see a bullish reaction targeting the 13000 and 1307 levels.

Beyond 1307, there will be significant resistance inside the 1320 - 1328 zone. If the bears clear the interim support at 1277, I think it is very likely that the pair will revisit the 1268 level which converges with the bottom of the Ichimoku cloud on the daily chart.