The XAU/USD pair continued to sink yesterday and touched its lowest level since April 4. However, trading was subdued, as several markets remained closed for the Easter holiday. Although the pair found support and erased some of the initial losses after touching the 1283 support level, the settlement was still below the $1293 an ounce. It seems that there is no real interest in gold as signs of an improving U.S. economy play a crucial role on investors’ sentiment.

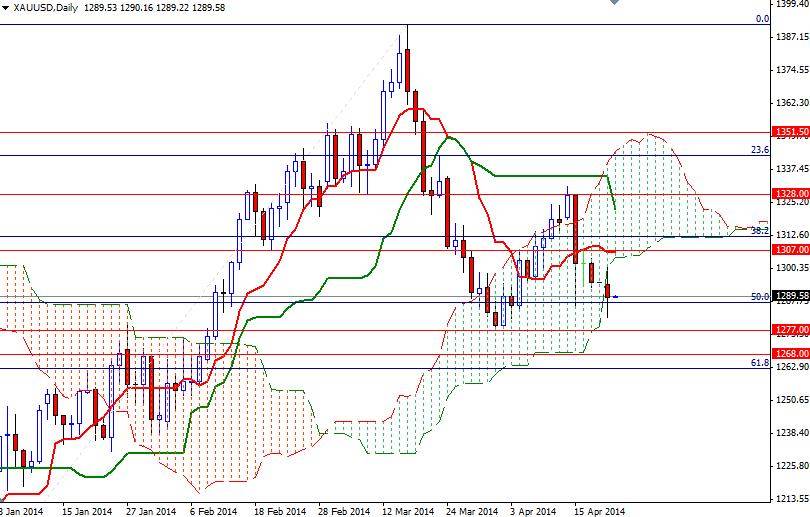

Of course, the market remains vulnerable to any escalation in global tensions over Ukraine though right now people are not in a panic mode. Because of that, I will be paying more attention to the technical levels. Speaking strictly based on the charts, the location of the Ichimoku clouds on the daily and 4-hour time frames shows the bears are in charge and there are strong resistance levels to the upside. Bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on both charts also give advantage to the bears.

If the downward pressure continues and prices break below the 1283 support level, then it is entirely possible that we will see the pair retesting 1277 and 1268. Closing below this support would increase speculative selling and drag the market towards 1256. In order to regain their strength and march towards the 1307 level, the bulls will have to push the XAU/USD pair above 1293. Breaking through that resistance level would make me think that the market is going to tackle the 1312 level again.