The XAU/USD pair posted first weekly gain in two weeks as the conditions in the marketplace increased desire for safe-haven diversification. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 81833 contracts, from 79292 a week earlier. Much of the volatility was driven by rising tensions along the Russia/Ukraine border so the market ignored a series of encouraging U.S. data that reinforced expectations of a pick-up in economic growth and a continued reduction in the Fed’s asset buying program.

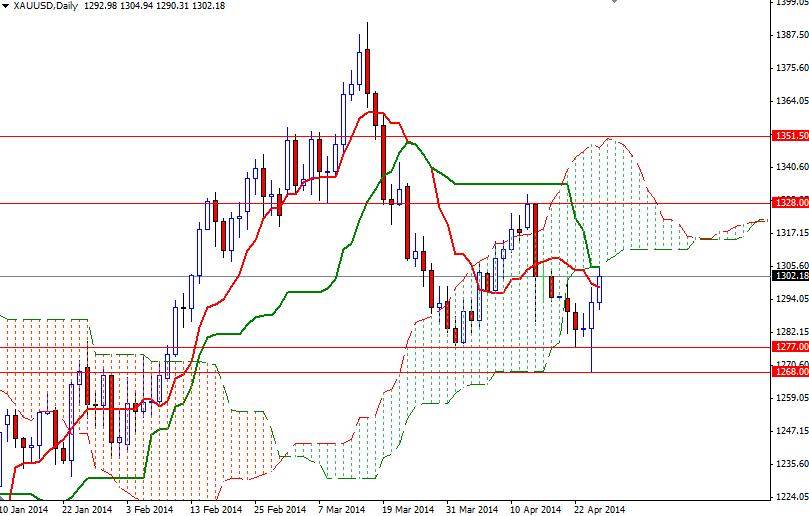

The XAU/USD pair initially fell to a ten-week low of 1268.42 before recovering to 1302.18. As a result the pair printed a hammer on the weekly chart. Although this rebound suggests that lower prices are rejected by traders, I am cautiously bullish on this pair in the short term as price action is based on the fear factor rather than technical elements. With that in mind, I think a break above the 1307 resistance level, which intersects with the descending trend line, is necessary to confirm that the bulls are not going to give up. If that is the case, we could possibly see the bulls make a run for the 1316 level.

A close above that resistance would signal that the pair is most likely headed for the next strong resistance levels at 1323.50 and 1328/30. However, if the bulls fail to break through the Ichimoku clouds and prices start to fall, support can be found at 1293/0 and 1285. The bears will have to push the market below 1285 in order to gain enough power to tackle the 1277 support level.