The XAU/USD pair (Gold vs. the American dollar) closed yesterday's session higher than opening after two consecutive days of losses. It seems like falling prices lured some buyers back to the market. The latest gold sell-off was initially ignited by the concerns over slowing Chinese economy and growing perception that the first rate hike -in the U.S.- could occur as early as the spring of 2015.

Persistent uptrend in the U.S equities markets has been another important element sapping gold's safe-haven appeal. Yesterday, data from the world's biggest economy came out better than expected but were more or less in line with market expectations. The Commerce Department reported that factory orders rose 1.6% and data released by the ADP Research Institute revealed that private sector added 191000 jobs in March.

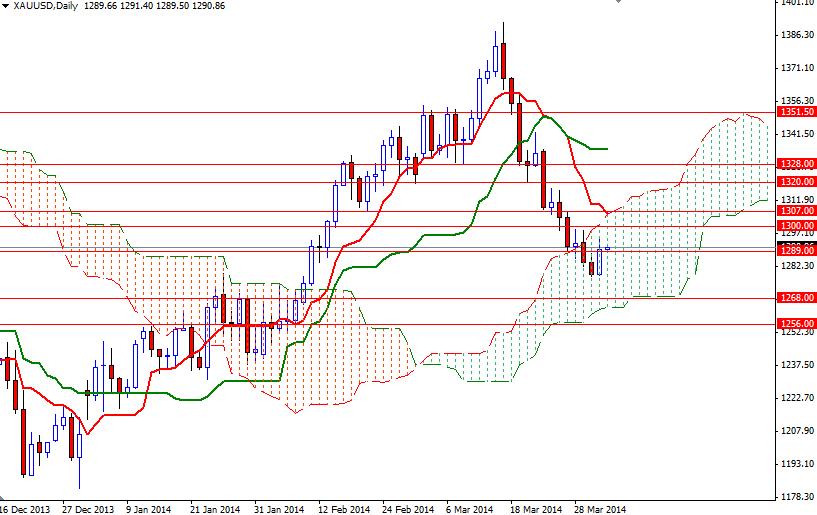

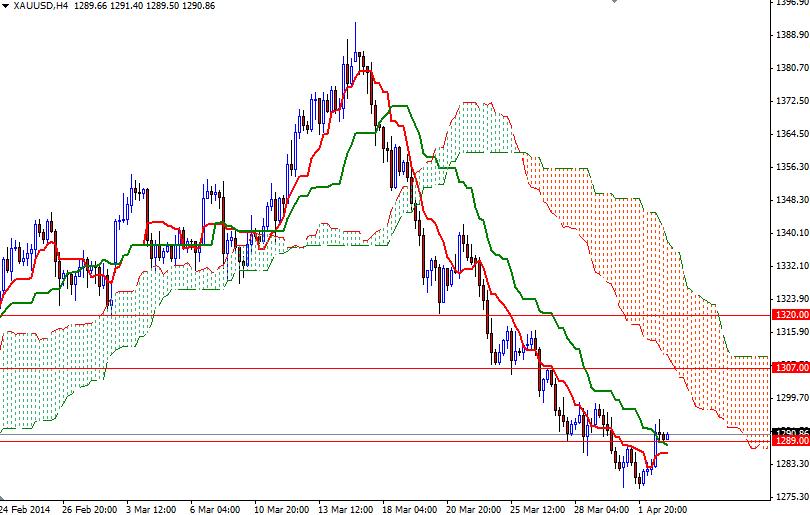

Right now prices are inside the Ichimoku clouds on the daily chart and that means the pair is looking for a direction. There are times that the market seems to move through but fails somewhere in the middle of the cloud - as we saw earlier when the pair failed to penetrate the cloud on the weekly chart and printed a bearish engulfing pattern. When this happens we should watch the price action to see if it will give a reversal signal.

With that in mind, I think the XAU/USD pair will need to break either above 1320 or below 1268 before it can resume trending. The first resistance ahead of us is located at 1298-1300 and this is the level which the bulls have to break in order to push prices higher. In that case, I will look for 1307 next. To the down side, there is an interim support at 1289/6. If the market drops below that level, then we will probably test the support at 1277. A daily close below 1277 would suggest that we might revisit 1268 soon after.