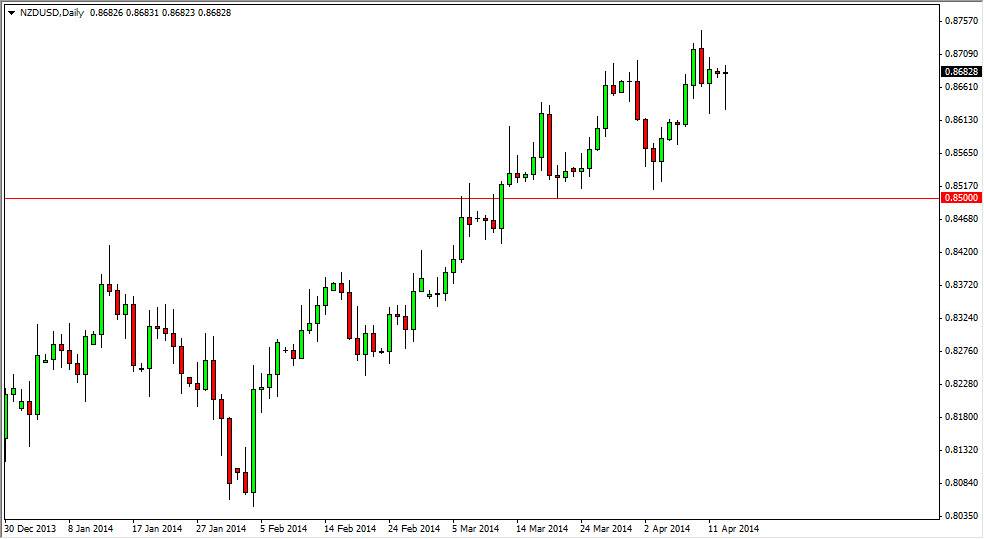

The NZD/USD pair fell initially during the session on Monday, dipping down below the 0.8650 level. That area offered enough support though, that we ended up bouncing to form a hammer for the second session in a row. That’s a pretty positive sign, and as a result I believe that this market will in fact continue its move to the 0.90 handle ultimately. On a break above the top of that hammer, I believe that the buyers would start to take control again, and we are most obviously in an uptrend, so that’s going to be the way to go anyway.

I think that the New Zealand dollar will continue to react to the global risk appetite, so paying attention to the stock markets and futures markets around the world will be the way to look at whether or not the New Zealand dollar should continue to gain. Quite frankly, I think that this market does continue to go higher given enough time, but at the end of the day we will continue to see choppiness going forward.

I do see some type of “floor” in this market.

I think that there is a floor in this market. I see it at the 0.85 level, which is a large, round, psychologically significant number. With that, I believe that buyers will step in every time we go down towards that area. Because of that, this is a “buy on the dips” type of market, and that’s exactly what I will plan on doing going forward. I do ultimately believe that we go to the 0.90 handle, and that has been my long-term target for some time. It really isn’t until we get below the 0.85 level that I even begin to think about bearish action, and quite frankly it’s not until we get below the 0.84 level on a daily close and I think the trend starts to fall again. All things being equal, I believe that getting involved in this market in small increments is probably going to be the way to go, as headlines continue to move the markets back and forth.