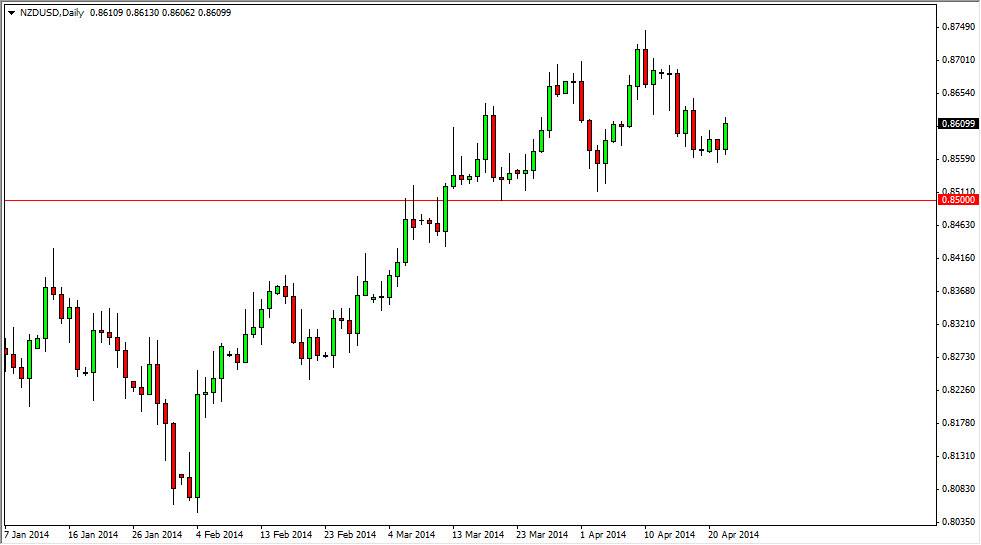

The NZD/USD pair rose during the session on Tuesday, breaking above the top of the hammer that had formed on Monday. This of course is a bullish sign and we did closed just above the 0.86 handle, clearing the large, round, psychologically significant number. With that in mind, I feel that the market does continue to go higher, and on a break of the highs from the Tuesday session I am comfortable buying but do recognize that there could be a little bit of choppiness above. That being the case, I take some solace in the fact that the 0.85 level has been so supportive lately, and the fact that the support area runs all the way down to the 0.84 handle. With that, I know that there is a lot of buying pressure and therefore selling certainly can’t be done.

Commodity and risk appetite driven.

Remember that this is a commodity and risk appetite driven currency pair. The New Zealand dollar typically does better when commodities rise, as well as risk appetite in general. Stock markets around the world had a significant move higher during the session on Tuesday, and it’s because of this that I feel that the New Zealand dollar will continue to strengthen anyway. I recognize that there is a significant amount of resistance at the 0.8750 level, but ultimately I feel that that area gets broken above and we do continue higher at that point.

I think that the longer-term target will be the 0.90 handle, but obviously it will be something that we had overnight. Nonetheless, yet be where the fact that the New Zealand dollar does typically grind a bit sideways at times, and then will suddenly move in one direction with some type of impulsive action. I feel that the market should continue to go higher, and the pullbacks will offer buying opportunities. Short-term traders will love this market as it certainly has an upward bias, and a fairly well-defined trading area. Shorting is absolutely impossible as far as I can tell, at least until we get down below the 0.84 handle, something that I do not see happening anytime soon.