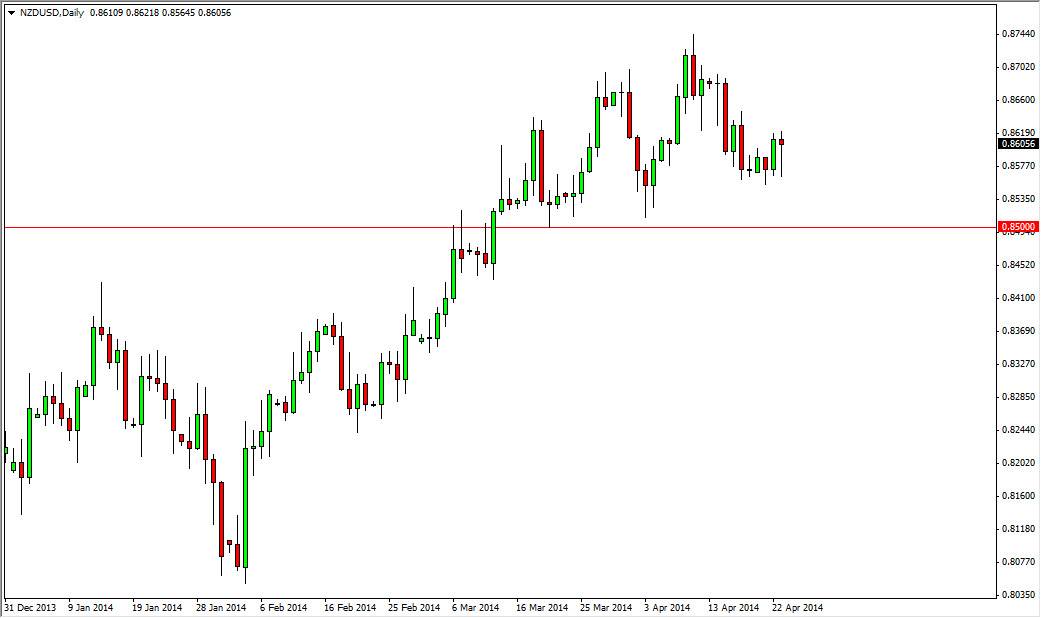

The NZD/USD pair initially fell during the session on Wednesday, but as you can see got a little bit of a boost towards the end of the day in order to turn things back around and form a hammer. The hammer is a supportive sign, which the fact that it formed at the 0.8550 handle of course has caught our attention as it has been an area of support recently. On top of that, there was a hammer that had formed back here bouncing off of the 0.85 large, round, psychologically significant number a couple of weeks ago, so we feel that the” floor” in this market is actually at the 0.85 handle.

The New Zealand dollar typically moves with the commodity markets and the economic strength or weakness of most major Asian economies. Remember, New Zealand is essentially the general market for Asian countries, and in that part of the world economic conditions can literally determine what foods are imported.

General consensus of the commodity markets will lead the way.

Even though there are a few somewhat illiquid futures markets that you can use for a bit of a “heads up” with the Kiwi dollar, the reality is that the cattle futures market is in exactly the place to risk any trading capital. On top of that, you cannot garner a lot of information out of that market because of the fact that it gaps so often.

Going forward, I fully anticipate see this market hit the 0.90 level again, an area that has been significant on the longer-term charts. I recognize that there is a lot of noise between here and there, so quite frankly I believe that short-term traders should begin to pick away at this resistance. Ultimately, I find it almost impossible sell the Kiwi dollar until we break well below the 0.84 handle, an area that looks well defended by the bullish traders out there. The large stop loss orders around the 0.85 level should continue to keep this market somewhat afloat, so therefore I am very bullish.