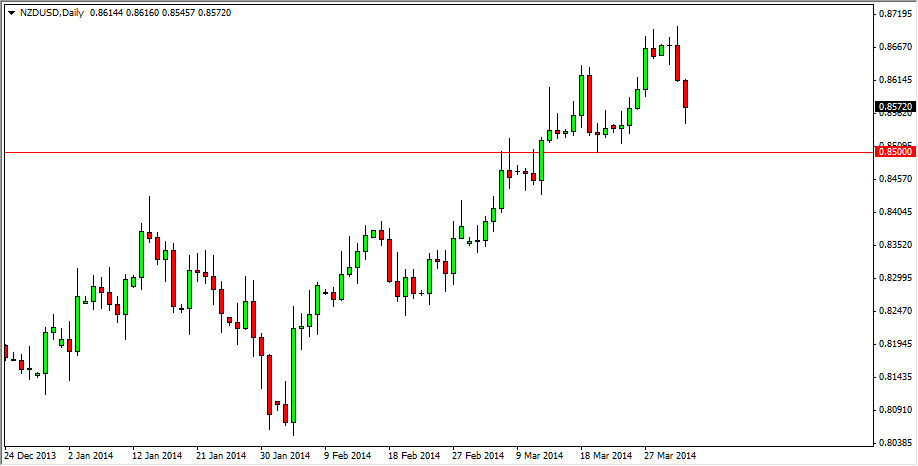

The NZD/USD pair fell during the bulk of the session on Wednesday, but as you can see we’re still above the 0.85 handle, an area that I have thought for some time to be rather supportive. With that in mind, I don’t really see any chance of shorting this market right now, and when I look at the charts I can make an argument for support all the way down to the 0.84 handle. With that in mind, this is still essentially a “buy only” type of market, even though it doesn’t necessarily look that enticing at the moment.

Remember that the New Zealand dollar is highly sensitive to the commodity markets in global risk in general, and with the Chinese manufacturing numbers coming out kind of weak earlier this week, I believe that the New Zealand dollar is been somewhat punished for it as a sensibly of their exports into the Asian region. Nonetheless, I believe that sooner or later the interest-rate differential will come back into play, and the New Zealand dollar will be picked up against other currencies such as the Japanese yen which will have a bit of a “knock on effect” in this market.

0.85

I still see the 0.85 handle as being rather supportive, and since we’re still above it, and have absolutely no interest in shorting this market. I would be all over some type of supportive candle in that region, especially if it is after the nonfarm payroll announcement comes out this Friday. After all, the nonfarm payroll announcement will have a massive effect on the risk appetite of global markets, as it is considered to be the “granddaddy” of all economic announcements.

Going forward, I want to see this pullback find support close to the 0.85 handle in order to start buying. I would even consider going long on short-term charts, as they should show the ability to support the market in this region, and have buyers step back in as the New Zealand dollar continues to offer an attractive yield relative to the US dollar.