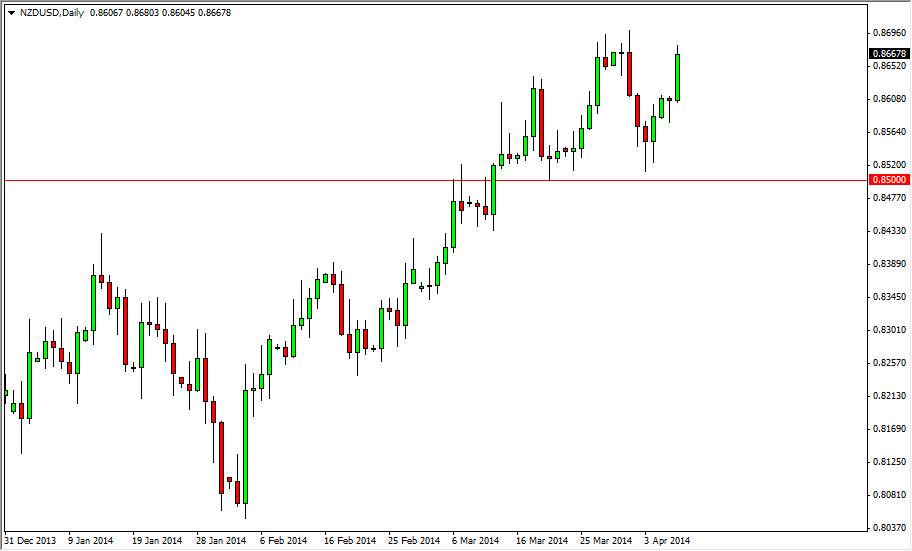

The NZD/USD pair rose during the session on Tuesday, breaking the top of the hammer from the Monday session. The hammer from the Monday session of course suggested that we were going to see more buyers step into this marketplace, and that has in fact happened. The market slow down near the 0.8680 level, and as a result I believe that the market will continue to find the 0.87 level as resistance, and because of that it’s not until we break to a fresh, new high that I’d be comfortable buying and less of course we pulled back and form some type of supportive candle.

I also believe that the 0.85 level is pretty massive as far as support is concerned. I believe that the market is basically finding the area to be a “floor” at that area. That level has been supportive a couple different times now, and as a result I believe that until we get below that area it’s almost going to be impossible to short the New Zealand dollar.

Commodity driven rally?

It’s possible that this could be a commodity driven rally given enough time. After all, the New Zealand dollar tends to be driven by the overall attitude of commodity markets in general, and is uses a “barometer” of risk appetite around the world. I cannot help but notice that some more of the stock markets around the world look like they found a bit of a bottom during the session on Tuesday as well, so it’s possible that we may have a general “risk on” type of rally. If that’s the case, I feel that the New Zealand dollar will continue to gain.

Also of note is the fact that the Australian dollar has broken out, which can be a bit of a leading indicator. After all, the Australian dollar and the New Zealand dollar tend to follow each other, and with the Aussie breaking out, I am a hard time believing that the New Zealand dollar doesn’t do the same given enough time. Obviously, I need to see this market break above the 0.87 level to do so, or perhaps a pullback closer to the 0.85 level that show signs of support.