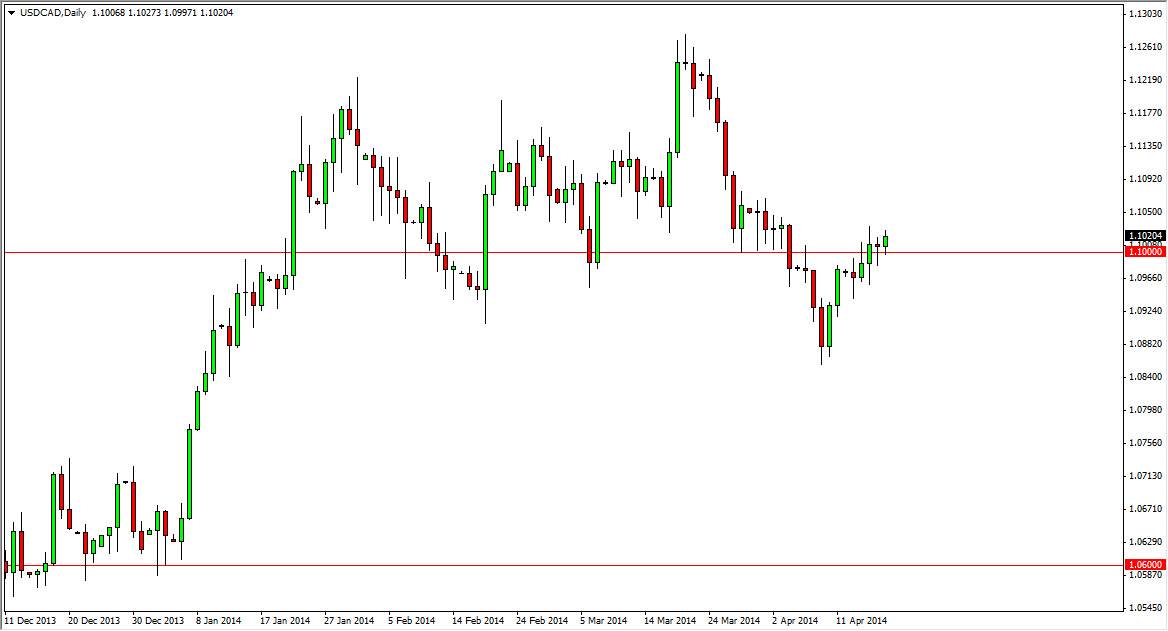

The USD/CAD pair fell slightly during the session on Friday, but found enough support of the 1.10 level to remain afloat. That’s not a big surprise, most bankers would have been away on holiday anyway, so it makes sense that we wouldn’t do much during the session. Because of this, I don’t look at this chart to closely due to just the Friday candle, but I do recognize the fact that the 1.10 level is important, and will have a significant effect on the future of this pair.

Looking at this area, the fact that we have broken back above it is a very strong sign for me, and the weekly chart featured a hammer from the previous week that is now broken to the upside. That is a clear buy signals far as I can tell, and therefore I will be doing exactly that. However, I recognize that there is a bit of resistance as the bone so I’m going to wait until the market gets above the 1.1060 handle or so in order to start going long.

Continued bullishness to 1.13 and beyond.

I believe that we will see the market break higher and head towards the 1.13 level again. I also recognize that on the longer chart, the 1.15 level is more significant, so it’s only a matter of time we breakout above the 1.13 level and head towards there. It appears that there is a significant amount of support just below now, so I’m not necessarily word about the market falling, and would look at any pullback from here as an opportunity to start buying a market that is undervalued.

The Bank of Canada continues to espouse a loose monetary policy, while the Federal Reserve has at least taken some steps to tighten theirs. If that’s the case, the interest rate differential between bond markets in both the United States and Canada should continue to tighten, and that should mean that the US dollars essentially undervalued. With that, I am buying on a break slightly higher, and will look at pullbacks with suspicion as there should be plenty of support.