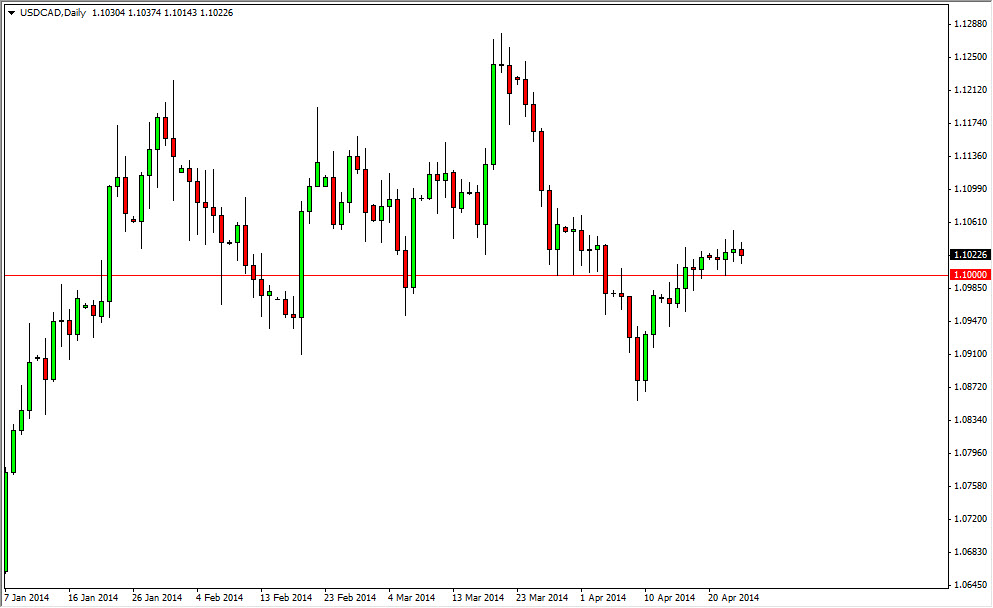

The USD/CAD pair did very little during the session on Thursday, as we continue to meander just above the 1.10 level. With that, I believe that this market will continue to grind sideways, but in the end I also believe that the buyers will start take over again. After all, on the weekly chart we formed a hammer two weeks ago, and we have recently broke up above the top of that candle. That’s a longer-term buy signal, and a move higher from here could very easily have this market looking for the 1.13 level. That would be a simple return to the top of the consolidation area that we have been in for months now.

Ultimately, I’ve noticed that the oil markets and the value of the Canadian dollar have somewhat decoupled lately, and that of course is a bit odd. If oil rises and it can’t help the Canadian dollar that shows just how significantly weakened the Canadian dollar is at the moment.

Continuing higher, but patience will be needed.

I believe that this market does in fact continue higher, but you are going to have to be patient considering that it likes to grind sideways for long periods of time. After all, both of these economies are fairly intertwined, and as a result I believe that it is more or less a common state of affairs if we go sideways. However, we have massive moves in one direction or the other and possibly, so I believe that sooner or later that’s going to happen. With that, you may choose to simply write out the storm by being long of this market in this general vicinity.

It is not until we get below the 1.09 level that I would be even remotely interested in selling this pair. At that point time, we could see this market go as low as 1.07, but in the end I still believe that the buyers will take control. Eight drop down to that level should bring in a lot of buyers as well, so either way, I feel that this market is going higher in the long run.