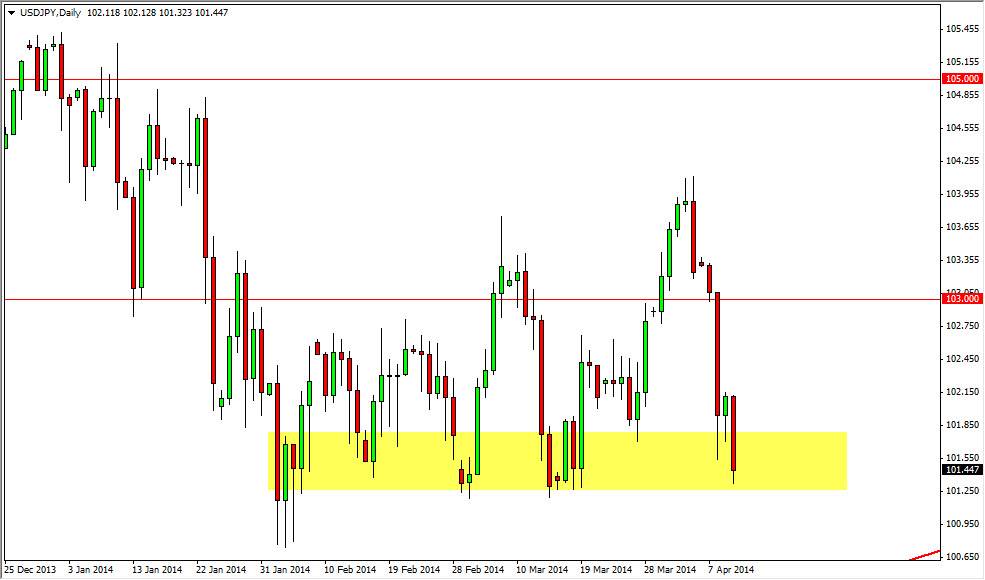

The USD/JPY pair fell during the session on Thursday, slamming into the 101.50 level. This general area offers quite a bit of support, and has going all the way back to the end of January. It is because of this that I’m interested in buying this pair on a supportive candle. Obviously, we don’t have it yet and the fact that we broke down below the hammer from the Wednesday session is something to be kind of concern about, but at the end of the day that was not major support, so I’m not going to put too much into it.

A supportive candle during the session today would be in my opinion an excellent buying opportunity. After all, I can see that the market could very easily go back to the 102.50 level, and ultimately the 105 level given enough time. The 103 level of course is reactive as well, so that being the case I would expect a bit of choppiness.

It’s all about the Japanese yen in the long run.

I believe that this pair is going to be more indicative of what’s going on with the Yen than anything else. Keep in mind that the interest-rate differential should continue to expand between the two economies, so ultimately that should favor the US dollar given enough time. That doesn’t mean that is going to be an easy move higher. When markets bottom like this after a massive selloff like we’ve seen over the last several years, it tends to be a very messy affair. This has happened in this market previously, especially when you look at the region of the year 1995. That was a positively messy bottom in this market, and this looks a bit like that. With that in mind, I believe that ultimately we will break out to the upside, but this is more or less a long-term call. I am short of the Japanese yen in general, although I must admit it’s not in this pair. A supportive candle during the session today though might change that.