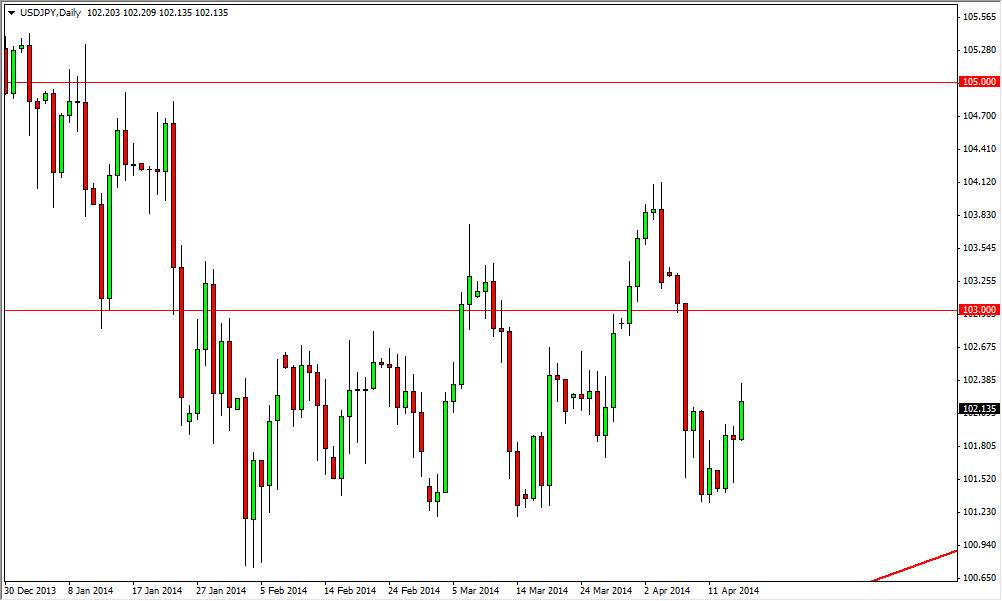

The USD/JPY pair rose during the session on Wednesday, breaking above the 102 handle. This of course is a bullish sign but we did break down a little reporting of the day. I suspect that the market will continue to have bullish pressure in it, but there are also plenty of people out there willing to sell as this is a pretty consolidated market. With that, we believe that the market will head to the 103 level, but will more than likely struggle between here and there. This is a choppy marketplace, and I see nothing that tells me on this chart that things are about to change.

The 103 level will offer significant amount of resistance, but I think it will be over, eventually. That leads us to the 104 level, and then the 105 level. Because of this, we feel that the market will continue to be positive, but again you’re going to have to be able to withstand a lot of choppiness between now and then. Quite frankly, this is more or less a longer-term recall by me, and I do believe that ultimately this period is much higher.

Buying on the dips and adding to the position.

As far as I can tell, the best route to take in this market is to buy on the dips, and continue going long in small increments. Ultimately, I plan on having a large position in this market, but recognize land this is something that should be built up over time. With that, I am very bullish but am also willing to take my time getting involved. Ultimately, I think that the market heads to the 110 level, but that’s probably going to take the better part of the year. In fact, I believe that this market ultimately goes much, much higher than that, so what I have been doing is shorting the Japanese yen against higher yielding currencies. Eventually though, this pair should continue to go higher just as they do especially once the Federal Reserve starts to raise interest rates, which isn’t coming soon, but it certainly is coming sooner than it is in Japan.