USD/JPY Signal Update

Yesterday’s signals expired without being triggered as the price never reached either 100.88 or 103.00.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made before 8am tomorrow (Friday) London time.

Long Trade 1

Enter long with a buy limit order at the first touch of the 100.88 level.

Place the stop loss at 100.38.

Adjust the stop loss to break even when the price reaches 101.24.

Take 75% of the position as profit at 101.24 and leave the remainder of the position to run.

Long Trade 2

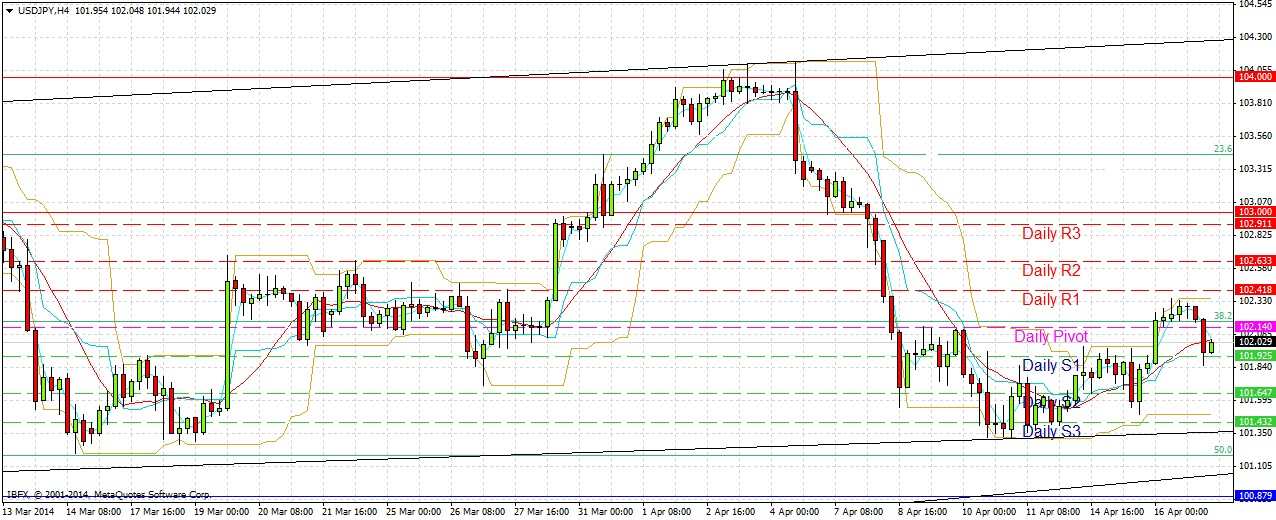

Enter long following confirming bullish price action on the H1 chart following a first touch of either of the bullish trend lines shown in the diagram below. The trend lines are currently at 101.36 and 101.04.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 101.90.

Take 75% of the position as profit at 101.90 and leave the remainder of the position to run

Short Trade 1

Enter short with a sell limit order at the first touch of 103.00.

Place the stop loss at 103.32

Adjust the stop loss to break even when the price reaches 102.45.

Take 50% of the position as profit at 102.45 and half of the remainder after that at 102.05. Then leave the remainder of the position to run.

USD/JPY Analysis

The pair saw some USD strength yesterday which has fallen off somewhat. Although it looked heavy, the support below 101.50 has held yet again.

We seem to be caught in a long-term, slightly bullish wide, ranging channel, as shown by the trend lines in the diagram below.

The lower bullish trend lines should give good opportunities for long trades, although the fact that there are two trend lines creates a fairly ambiguous situation.

There is a good flipped support level below both of the trend lines at 100.88. Above us there are no significant flipped resistance levels before 103.00.

It is very difficult to predict what will happen next.

There are no high-impact news releases due today concerning the JPY. At 1:30pm London time there is a release of US Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm. Therefore it is likely to be fairly quiet for this pair before the New York open. The Tokyo session may be relatively lively as Japan does not have a public holiday tomorrow.