USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired as the price never reached either 101.91 or 103.00.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made before 5pm today New York time.

Long Trade 1

Go long upon a first touch of the lower bullish trend line, currently at 101.28.

Place a stop loss 27 pips below the entry.

Move the stop loss to break even when the price reaches 101.88.

Remove 50% of the position as profit at 101.88, then half of the remainder at 102.20.

Close the trade at 103.00.

Short Trade 1

Go short following confirming bearish price action on the H1 chart after a first touch of 103.00.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 102.73.

Remove 25% of the position as profit at 102.73, then 50% of the original position size at 102.43, and then leave the remainder of the position to run.

USD/JPY Analysis

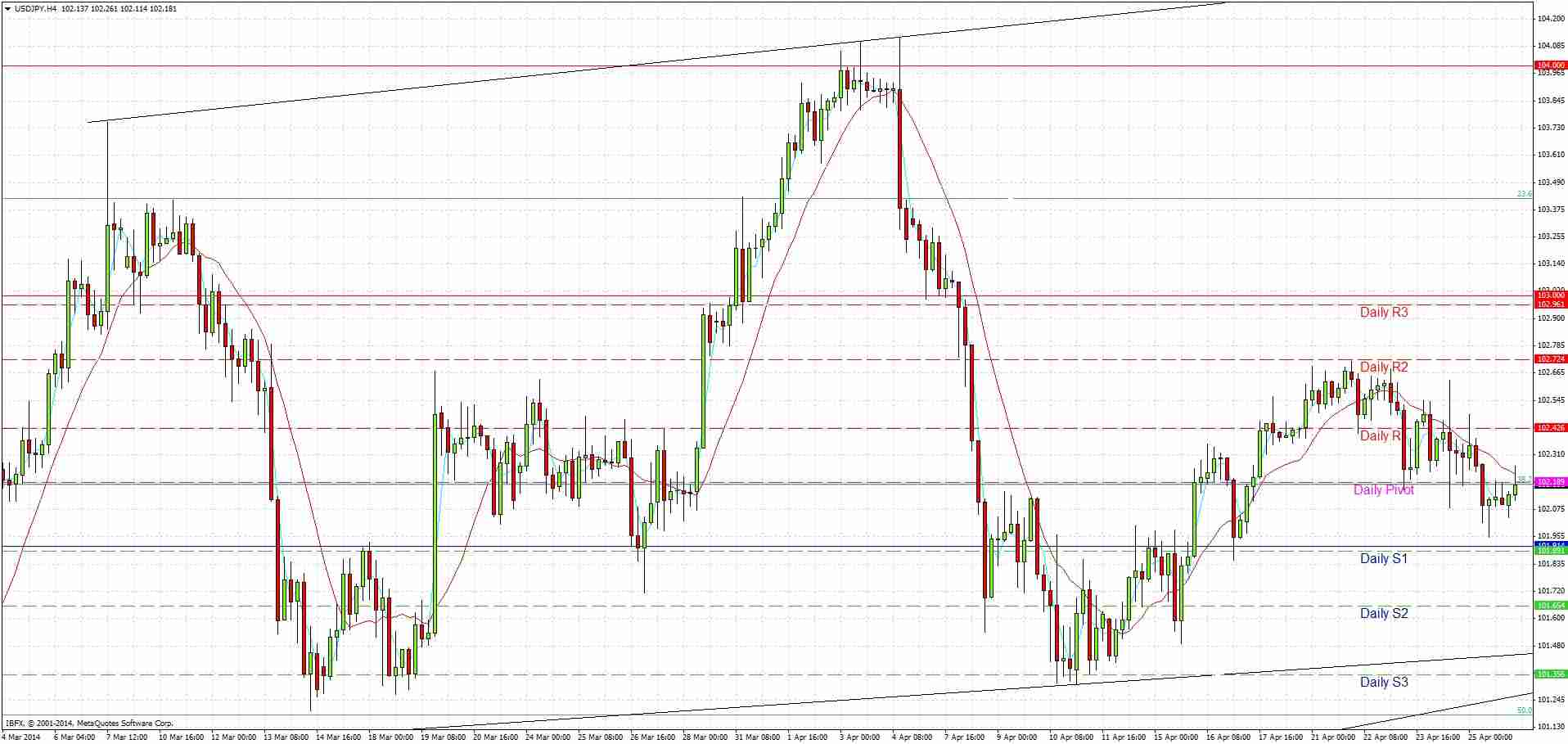

The pair continued its gentle descent within its gentle ranging slight overall upwards trend last week. On Friday we came to within just a few pips of the 101.91 level I had identified as being likely support and has already risen more than 30 pips from there, so I am not looking to that level again for support just yet.

Instead for support I am looking for a first touch of the lower, very long-term bullish trend line that is currently sitting at around 101.28. It is unlikely we will hit that line today and it will rise. This trend line has not been hit since October last year and has in fact held since June last year. It was the lower trend line of the summer triangle. We should get a good bounce off this line the next time that it is hit from any kind of distance.

The inner trend line currently at about 101.47 may also provide some support.

Above us we have likely resistance at 103.00.

I am not as bullish as my colleague Christopher Lewis and am prepared to take shorts in this market.

There is no high-impact news due today for the JPY and tomorrow (Tuesday) is a Japanese public holiday. At 3pm London time there will be a release of US Pending Home Sales which could affect the USD. It is likely to be a quiet day.