By: DailyForex.com

USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entry before 8am tomorrow London time

Short Trade 1

Enter short when confirmed by H1 price action at a retest and failure of both the trend line and the 103.00 level.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 102.75

Remove 90% of the position as profit at 102.60 and leave the rest of the position to ride.

Short Trade 2

Enter short at the first touch of 104.00.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 103.55.

Remove 50% of the position as profit at 103.55 and leave the rest of the position to ride.

USD/JPY Analysis

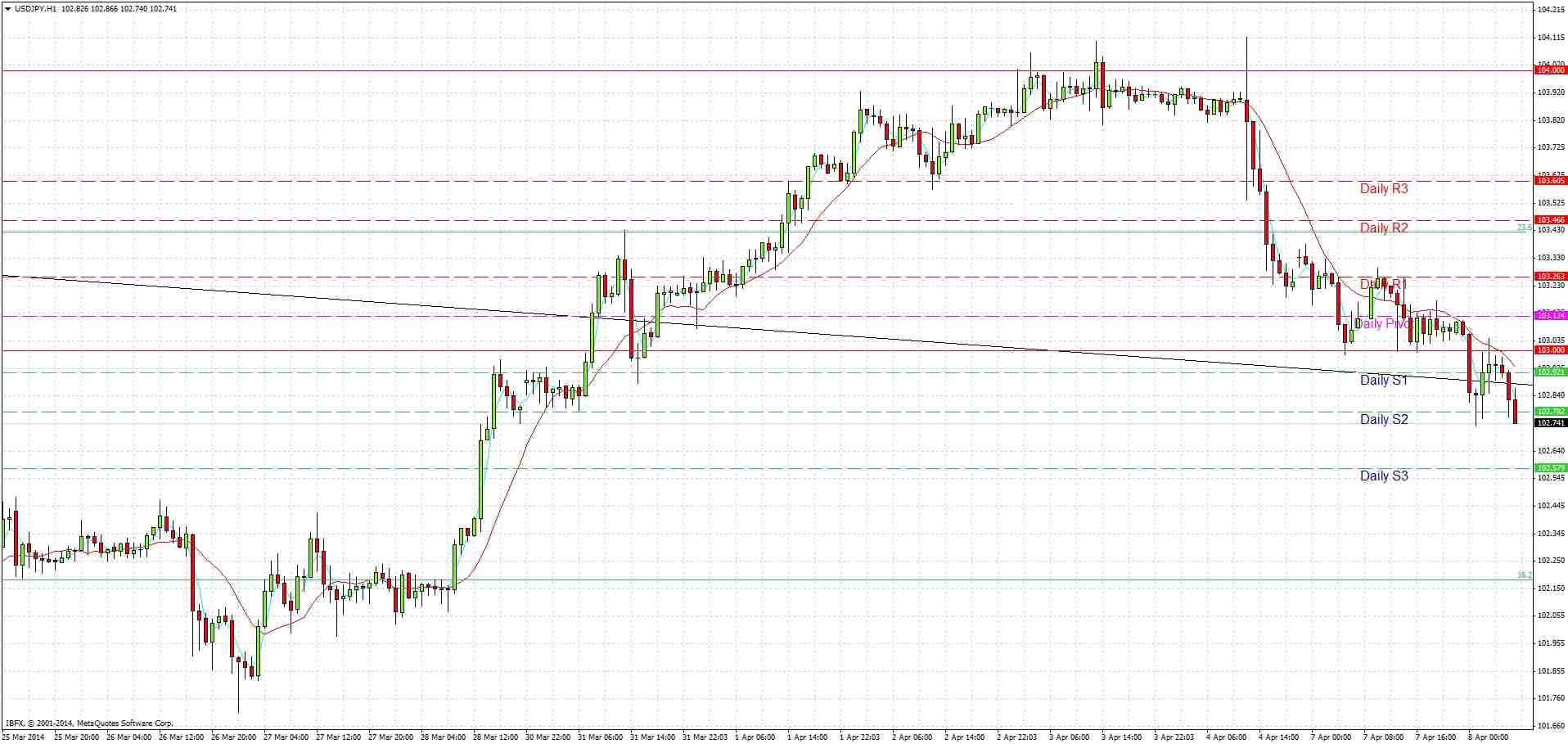

Things are looking interesting. Yesterday we saw an early move down to the support at about 103.00 which gave about 30 bullish pips, before the price fell again, keeping us out of any signal as I wrote that the price must not rise beyond 103.25 otherwise a long off the trend line would not be a good signal.

Now we have seen not only a break back below the bearish trend line which was the upper definition of the triangle that was holding this pair, but it also looks as though 103.00 has flipped from support to resistance. This is a bearish sign and suggests we are going to now move down and approach the key psychological level of 102.50 which is likely to hold before tomorrow’s high-impact USD news release.

This means it is possible to look for a short trade off a return to 103.00 as well as 104.00. The level at 104.00 is very unlikely to be hit, and is so far away from the current price that I would look for a touch trade there with a limit sell order. Regarding a short trade from 103.00, I would like to a see a single candle reject with its wick both the trend line and the round number at 103.00 as confirmation before entry.

There is no high-impact news due today concerning the EUR. At Xam London time there will be a Bank of Japan Press Conference which is likely to make this pair volatile.