USD/CAD

The USD/CAD pair is by far the most interesting one to me from a weekly timeframe at the moment. The market fell significantly below the support of the consolidation area that we had been stuck in for some time, but bounced enough to form a nice-looking hammer. With that, I feel that this market is ready to at least continue the consolidation that we’ve been in, if not accelerate to the upside as the downside has been proven to be wanting. Even if we break down below the bottom of the hammer which is a traditionally bearish sign, I think that the market will be able to fall much farther than 1.06 or so. All things being equal, I believe that this market is heading to the 1.15 level if we can get a break above the top of the hammer for the week.

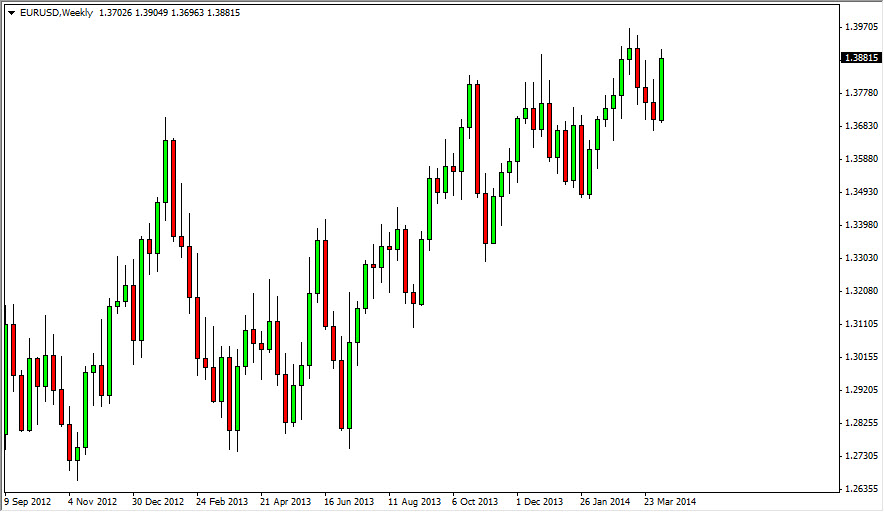

EUR/USD

The EUR/USD pair rose during the week, and quite frankly blew out a lot of stops to the downside. I don’t necessarily think that buying right away is the realm to go, but above 1.40 would be very interested in this market as it will have clearly broken through a downtrend line on the monthly chart at that point in time. I see no reason to sell this market right now, thereby I am just simply sitting on the sidelines and waiting for that signal to start buying.

NZD/USD

The NZD/USD pair rose during the bulk of the week, but did fell on Friday to impress. In fact, there was a bit of a shooting star form for Friday so I believe that this market is going to continue to consolidate at the moment. However, we did break out above some significant resistance, so I do think that ultimately this pair goes higher. A supportive candle just below, or perhaps a break of the highs from the range of this past week will be needed in order to start buying.

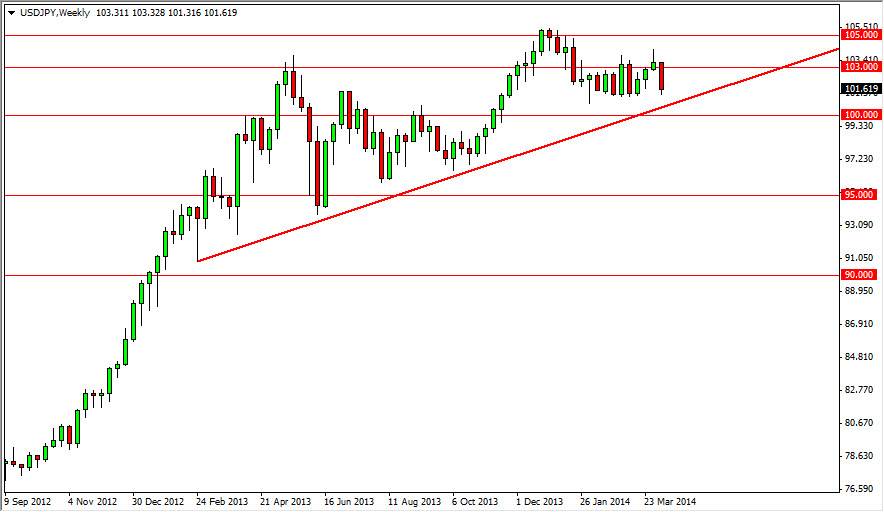

USD/JPY

The USD/JPY pair sold off rather stringently during the week, but as you can see we have found support at roughly 101.25 yet again. Between that and the uptrend in line that I have drawn on this chart, I think it’s only a matter time before the buyers take over again, wishing this market above the 105 level and on to areas such as the 110 level. I am short of the Japanese yen, just not in this particular pair.