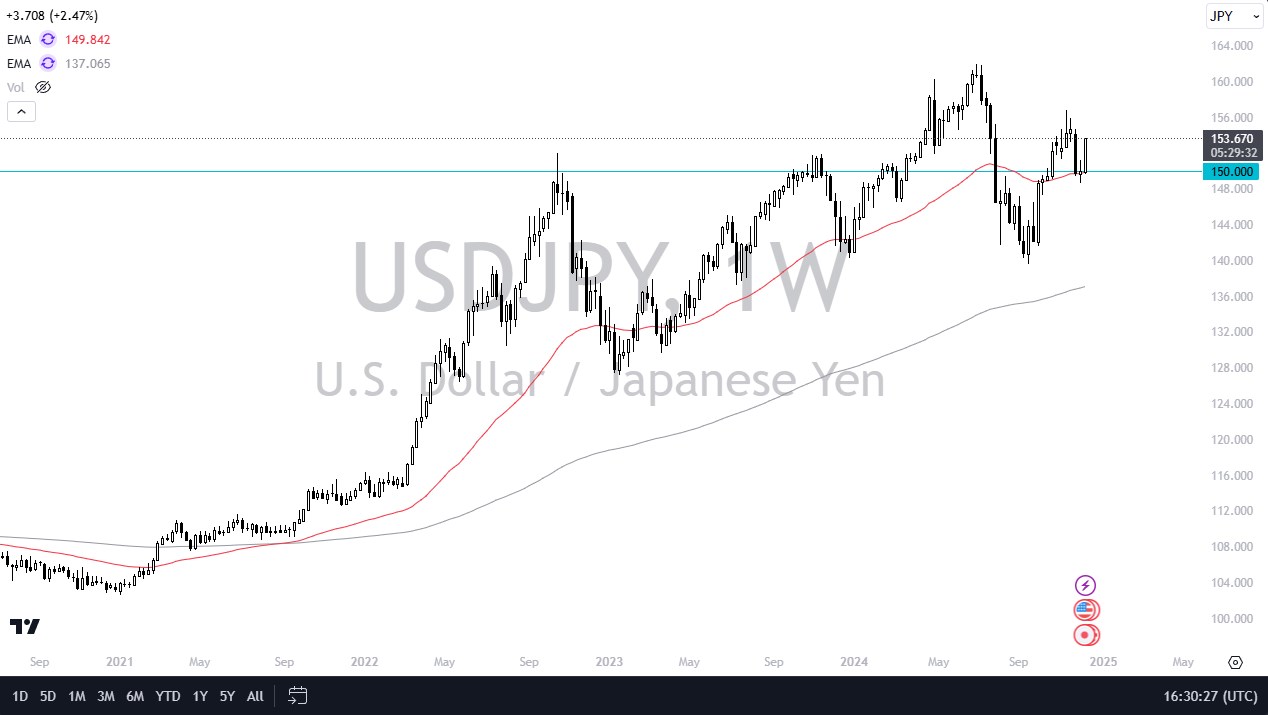

USD/JPY

The USD/JPY pair had a positive week, but didn’t quite reach the top of the recent consolidation area that the pair has been stuck in for a couple of months. However, I have an uptrend line drawn on the chart, and as you can see we are getting closer to it. However, the market is one that I am bullish of anyway, so I am looking to start buying this pair yet again. I think that the Yen will continue to weaken, and I am already short of the currency against some other currencies like the Turkish lira and New Zealand dollar.

EUR/USD

The EUR/USD pair fell slightly during the week, but still retains its overall bullish trend. I think that perhaps we will have to drift a bit lower at this point, but I am not convinced that the pair can be shorted. To be honest, this is a choppy mess with an upward bias in my opinion. If I were to take a position, it would be to buy – but as a long-term trade as there will be a lot of noise.

USD/CAD

The USD/CAD pair broke higher during the week, and managed to crack the top of the hammer from the week before. The pair looks set to get to the top of the recent consolidation in my opinion, and I think that the 1.13 level is probably going to be the next stop. To be honest, I feel that this market will break above there, and head to the 1.15 level, given enough time.

After all, the oil markets have been bullish, but the Loonie hasn’t enjoyed much demand. If that is going to be the case, something is seriously wrong with the C$. This recent action has been consolidation – and that normally means continuation in the end.

GBP/USD

The GBP/USD pair initially feel during the week, but found buyers below. The shape of the candle suggests to me that the market is ready to continue higher, and a break above the top of the range from this last week should have this market looking for the next obvious large, round, psychologically significant number – the 1.70 handle. With this, I am bullish, and I think that the 1.65 level should continue to be the “floor” in this market going forward.