EUR/USD

The EUR/USD pair has a slightly positive week, but only just slightly as the market had stayed in a fairly tight range. The market has been in an uptrend, but it has been very choppy, so truthfully I don’t have a serious desire to be involved in this pair as it is still going to be difficult going forward. There really isn’t a swap in this pair with most brokers, so hanging onto a trade for long periods of time isn’t worth it in my opinion.

AUD/USD

The AUD/USD pair tried to rally during the week, but fell back down to the 0.9250 level to look for support. The area should continue to be one of interest, but what catches my attention is the hammer from three weeks ago, showing support. It isn’t until we break below that hammer that I can start selling. At that point, I think we are heading towards the 0.90 region. On the other hand, if we get a bounce, we are heading to the 0.95 level.

USD/JPY

The USD/JPY pair fell during the week, but still remains in the consolidation that has plagued the market for a couple of months now. This market has a decent uptrend line though, and as a result I believe that this pair should continue to go higher given enough time. The pair is a “buy only” pair for me, and although I am not involved at the moment, I am long TRY/JPY, NSD/JPY, and a few others that pay a positive swap at the moment. Sooner or later, the USD/JPY pair should follow the uptrend. Given enough time, the Federal Reserve will have to tighten.

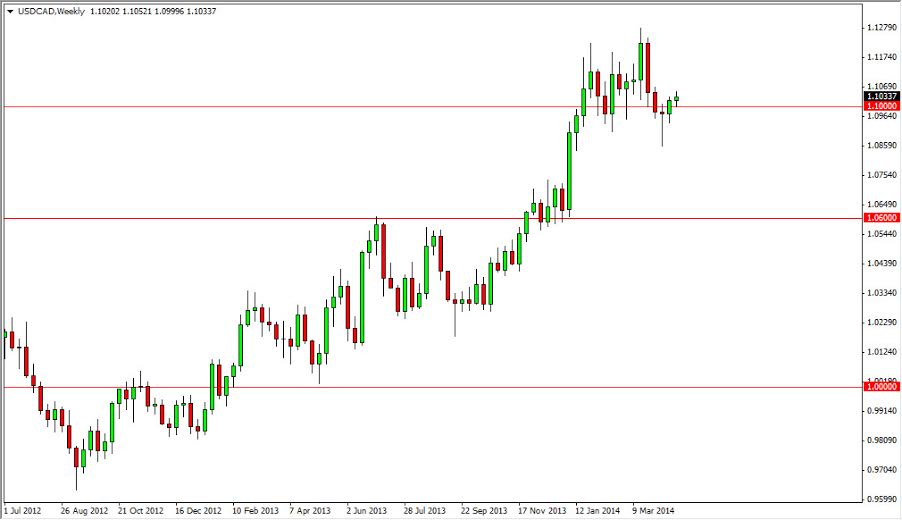

USD/CAD

The USD/CAD pair rose during the course of the week again, as we continue to climb above the hammer from two weeks ago. With this, I feel that the market is trying to break higher, and into the previous consolidation area just above current prices. I think that this pair goes to the 1.13 level, and then could break out to the 1.15 level after that. As for selling, I have no interest until we get below the bottom of the hammer from two weeks ago.