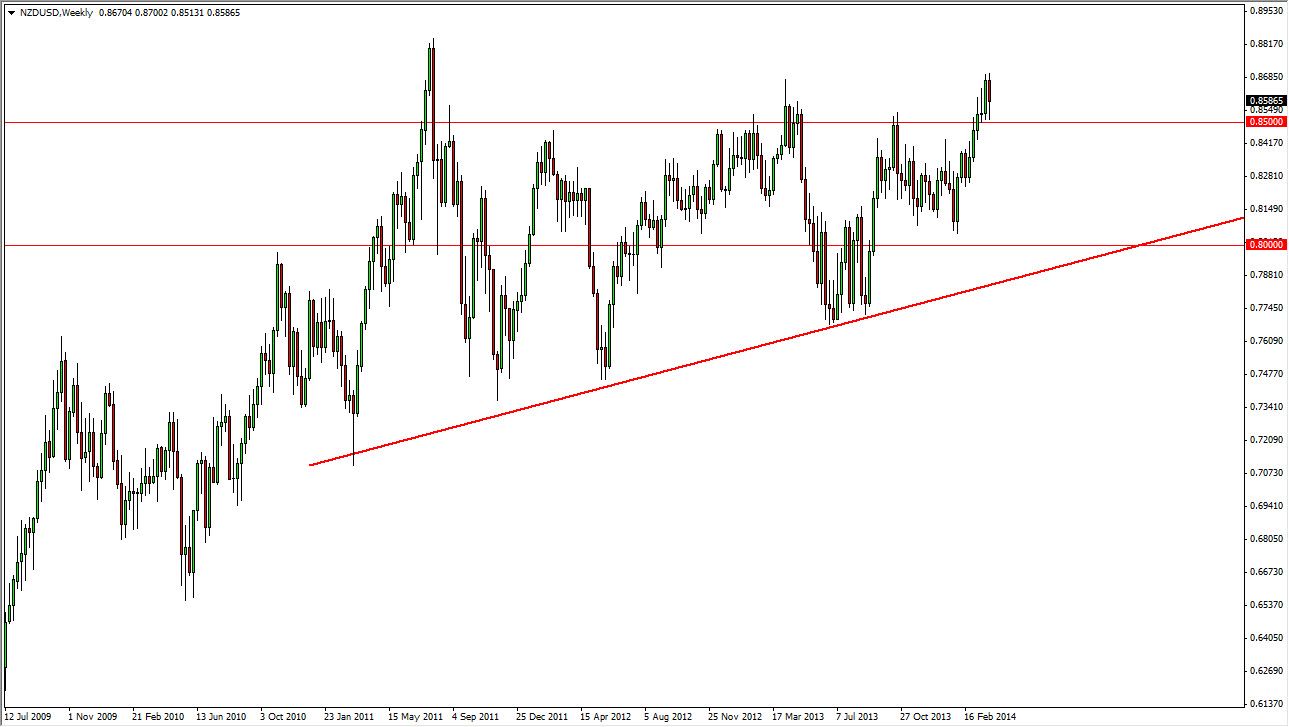

NZD/USD

The NZD/USD pair spent most of the week falling, but as you can see found enough support at the 0.85 level to turn things back around. What I find most interesting about this pair though is that we are comfortable up towards the highs, and as a result I feel that this market is ready to continue going higher. I would expect this market to head to the 0.90 level, but it doesn’t mean that is going to do it overnight. I think that there will be a lot of volatility between here and there, but the 0.85 level should continue to offer a bit of support to this market going forward.

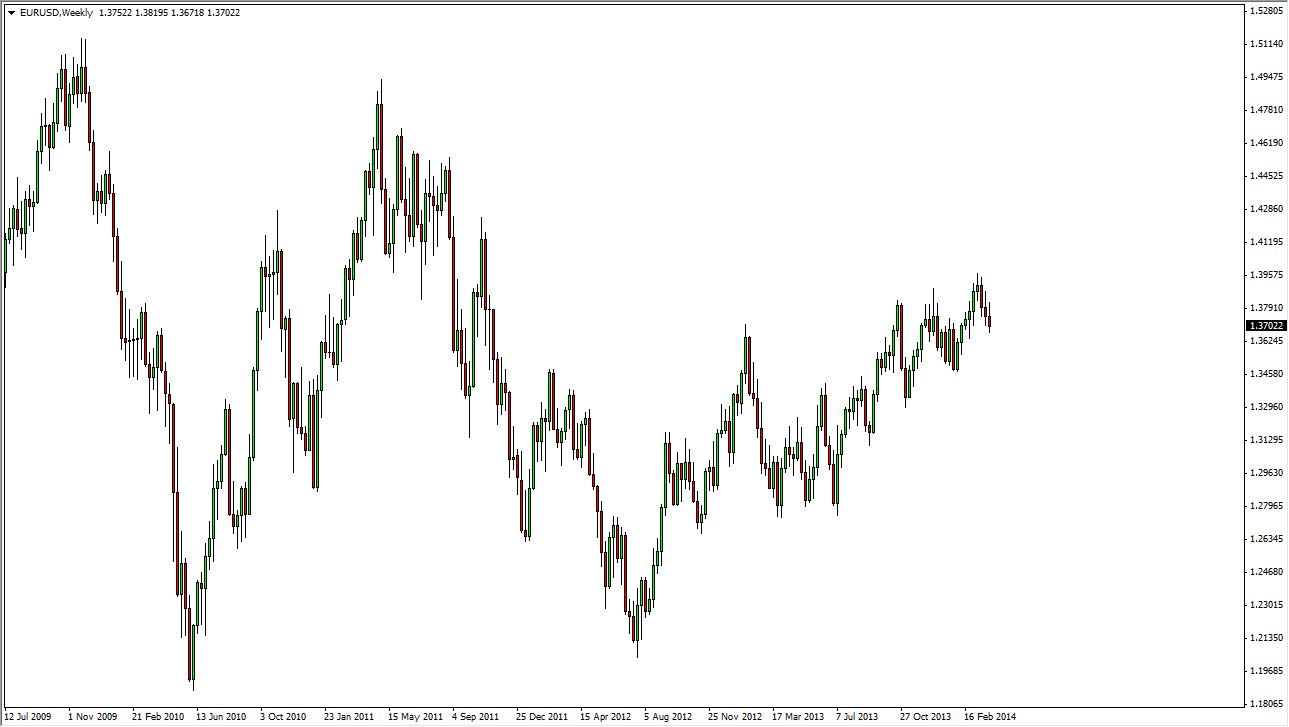

EUR/USD

The EUR/USD pair try to rally during the week as well, but as you can see, fell. The candle shape for the week is a shooting star, which of course is bearish but I’m not convinced about selling quite yet. This is especially considering that the Friday candle is a hammer, right at the 61.8% Fibonacci retracement from the most recent move. With that, I believe that this market will continue to grind higher, but don’t expect any type of smooth sailing between here and its ultimate destination, wherever that is.

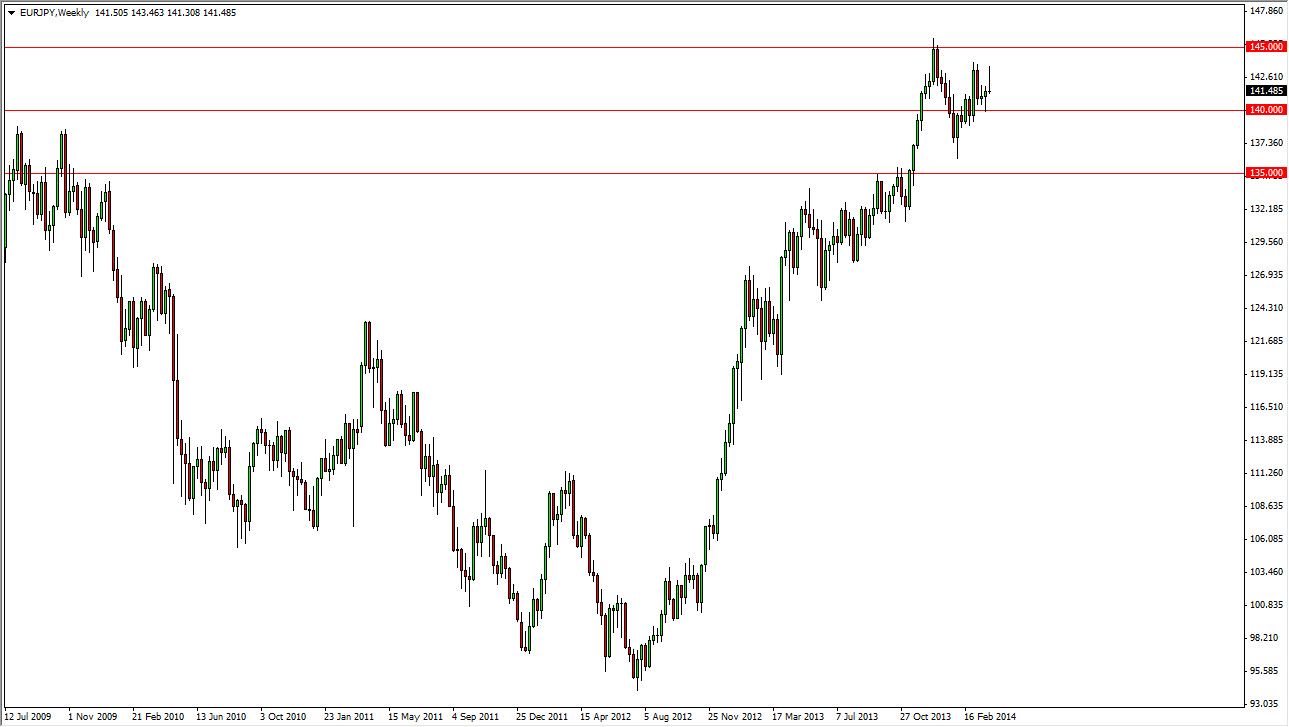

EUR/JPY

The EUR/JPY pair try to rally during the week as well, but gave back all of the gains in order to form a perfect shooting star. The previous week formed a hammer though, so I don’t think that the market is about the collapse or anything. Quite frankly, I feel that the 140 level will offer support again, and that we will more than likely consolidate between the aforementioned 140 level, and the 142.50 handle to the upside. Ultimately, I think this market heads to the 145 level, and higher than that given enough time.

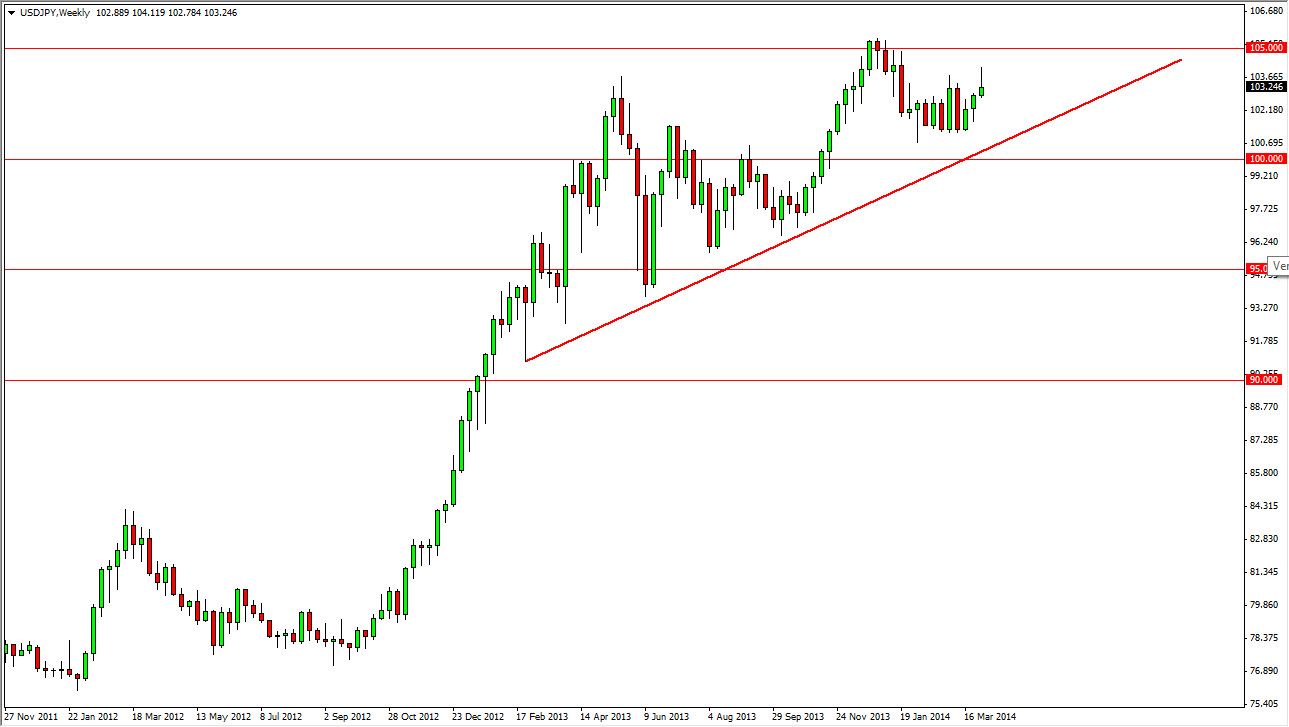

USD/JPY

The USD/JPY pair tried to rally during the previous week, but failed at the 103.50 level. The pullback formed a shooting star, and as a result it appears that the market is and quite ready to take off to the upside yet. We will more than likely consolidate between here and the 101 level in the next week or two, but I believe that this market still has a positive tone to it, and any pullback from here will continue to attract buyers as we follow the trend line higher. Ultimately, I expect the 105 handle to be broken to the upside and the market to continue to the 110 level given enough time.