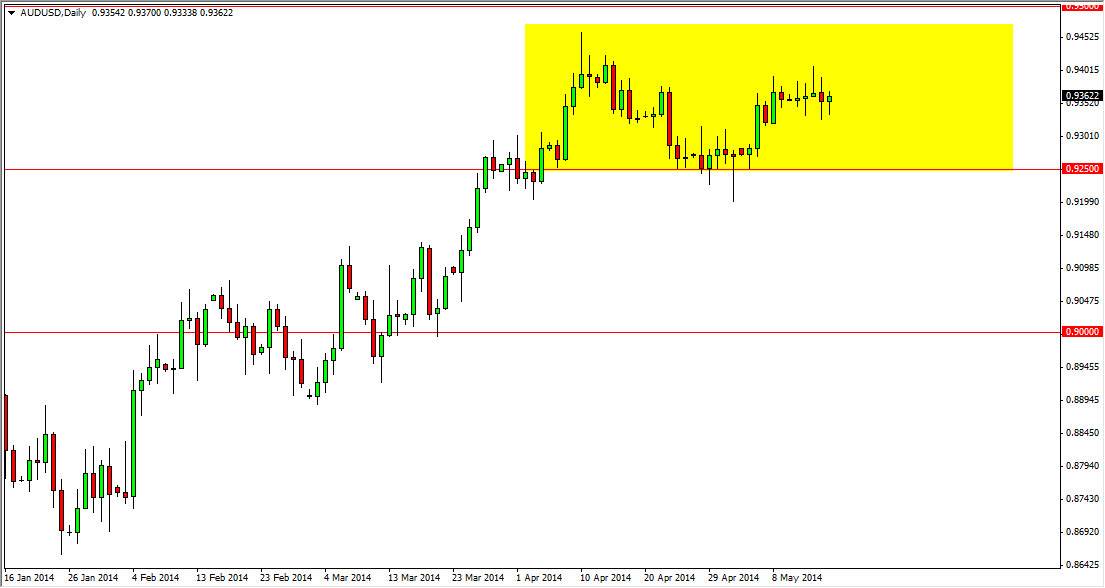

The AUD/USD pair has done very little during the last several sessions, basically hanging around the 0.9350 level. With that, the market seems like it’s trying to contemplate its next move. For myself, I fully believe that this market is going to go higher, but is going to do it at its own pace.

Even if we do pullback from here, I suspect that the 0.9250 level will be where the buyer start to step back into this market. After all, the area has been supportive recently, and was resistance back in March. With that, it makes sense that the market would be heading towards that area, especially considering that we are struggling a bit at the moment to continue the uptrend. However, I would also stressed that we aren’t exactly breaking down at this moment either, leading me to believe that there is just a bit of malaise in the market, not any type of fear.

Watch the gold markets as well.

For anybody who’s been trading Forex for a significant amount of time, the correlation between gold prices and the Australian dollar is a well-known one. Right now, the gold markets look like they are trying to figure out what to do as well, so I think this is simply a carbon copy of that market, albeit less volatile. With this, we feel that the market should find buyers as the gold market will at the $1280 level, but there may be a little bit of short-term pain to continue taking if you are long already. At the end of the day though, I feel that this market goes to the 0.95 handle given enough time.

It’s at the 0.95 level that I think things could get interesting, as the next stop would be parity. However, at that point in time I feel that the Australian dollar would improve itself to most traders out there, and we would continue a nice uptrend, which is exactly what I expect to see given enough time. Really at this point in time, it’s about waiting on the buyers to step back into the marketplace for me.