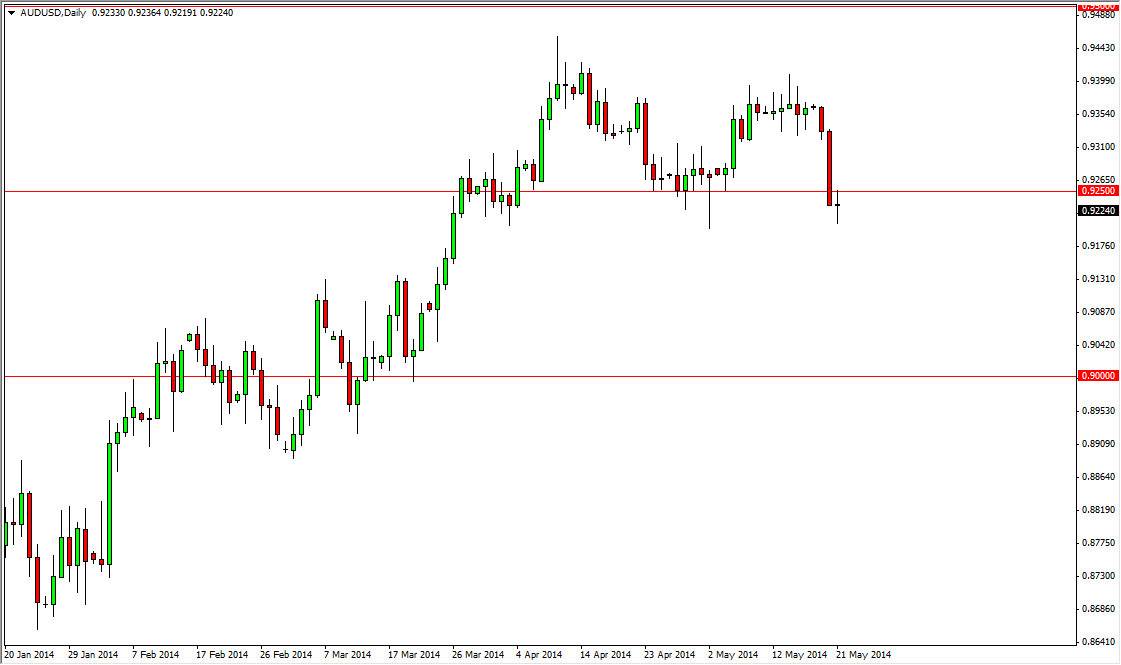

AUD/USD moved back and forth during the session on Wednesday, showing the 0.92 level to be supportive still, as that is the bottom of the larger support area that started at the 0.9250 handle. With that being the case, I feel that the market could very well bounce from here, even though we didn’t form a hammer, it suggests by a been so neutral for the day that the market could very well find buyers down here. That would just be a continuation of the consolidation that we’ve been in for some time now, and quite frankly that wouldn’t surprise me at all even though there have been some relatively dovish comments come out of the Reserve Bank of Australia recently.

I believe that we could probably bounce to the 0.94 area, which could be very resistive. With that being the case, I feel that the market will more than likely continue to go higher on a break above the top of the range. In other words, I believe that there’s more risk to the upside than down.

Follow the gold markets as well.

Follow the gold markets as well, as the Australian dollar is well-known for following gold in general. On top of that, the gold market seems somewhat range bound as well, and with that it makes sense that if we get a little bit of bullishness over in the commodity markets, we could in fact see that translate into a higher Australian dollar. Of course, the opposite is true if we see weakness in the gold pits, you could probably anticipate a breakout of the Australian dollar at that point.

Expect the move to be choppy nonetheless, as the markets themselves don’t seem very stable at this point in time. What I mean by that is that there’s very little in the way of certainty. I don’t expect impulsive moves, so really if we continue to go higher I would expect to see the market struggle overall, but ultimately could make it as high as the 0.84 level, but it may take quite a bit of effort to get there.