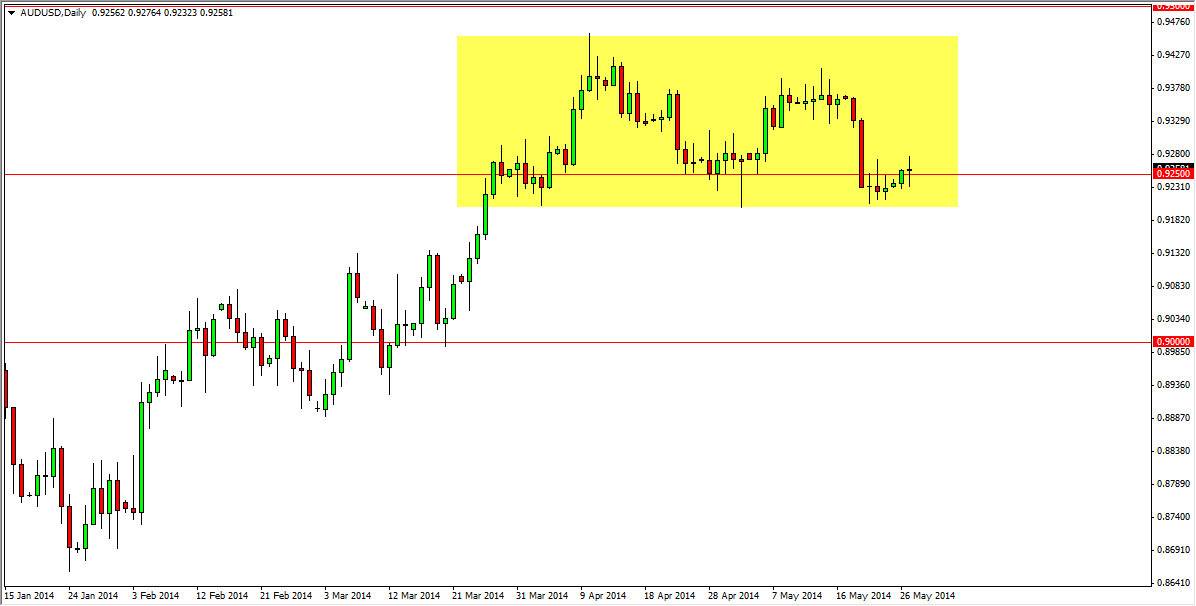

The AUD/USD pair went back and forth on Tuesday, as we continue to bounce around the 0.9250 level. This is an area that has been relatively supportive recently, and I believe that the support runs all the way down to the 0.92 level, as it is more or less a zone than anything else. On top of that, I believe that we are essentially in a consolidation area, and that it extends to the 0.94 handle. It is possible that we bounce from here, especially considering that we can’t quite break down, so that’s a possibility for me to start buying on a break above the highs of the session on Tuesday.

If we did break down below the 0.92 handle though, I would consider have to be a very sign and would assume that the market drops to the 0.91 level in relatively short term movement. With that in mind, I would look at that more or less is a “smash and grab” type of trade. That would be short-term and would be very easy to flip back around on signs of support. In fact, I would anticipate that the 0.90 level will be massively supportive, and as a result even if we fell down there I would be looking for a heavier position to the upside based upon support in that area.

Watch the gold markets

The gold markets had a fairly negative session on Tuesday, so it is possible that we do drift lower. Given enough time, the Australian dollar in the gold markets do tend to move in tandem, and with that I’ll be watching both of those markets at the same time. The gold markets do have significant support at the $1260 level, so if that level holds, I have a hard time believing that we break down too much from here. That more than likely would have the Australian dollar going higher in the short term, simply continuing the consolidation that we have seen since the middle of March. On the other hand, if the $1260 level gives way to the sellers, gold will drag the Australian dollar down given enough time.